How do I file the Michigan property tax credit(s) or home heating credit without the MI-1040?

The Michigan property tax credit(s) and the home heating credit may be sent separately without a federal return or MI-1040.

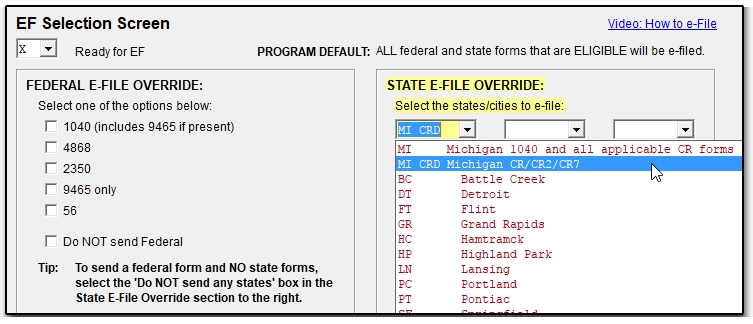

Within Data Entry, select the federal EF screen and choose MI CRD Michigan CR\CR2\CR7 from the drop list in the State e-File Override section.

MI stand-alone e-file authorization

A Michigan stand-alone filing that is ready to transmit will generate an MI-8453, which you should print, sign, and retain for 6 years. Do not mail the MI-8453.

Alternatively, if the taxpayer has filed a previous-year Michigan return, the taxpayer's "shared secrets" can be entered on the MI EF1 screen. In this case, a MI-8453 is not necessary and will not be generated. The "shared secrets" serve the same function as a PIN.

If you transmit the MI-1040 as a linked (piggyback) return then the Property tax credits will be sent along with the 1040 and you should not enter anything on the MI EF1 screen. If the MI-1040 is sent linked, do not select the credits to be sent stand-alone in the same transmission.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!