How do I enter the first-time home buyer credit repayment? How do I generate Form 5405?

A taxpayer who purchased a home in 2008, and received the First-time Homebuyer Credit, must repay the credit amount at a rate of 1/15th of the credit per year, from 2010 through 2025 (unless voluntarily repaid early).

Credit repayment is not required for a 2009 or 2010 purchase, however, certain events may trigger a repayment obligation.

Drake calculates the payment from information on the HOME screen.

- For your returning clients whose returns have been continuously updated since the purchase, Drake tracks the credit and automatically calculates the repayment when you open the HOME screen.

- The software inserts the repayment on the return and, if the IRS requires it, produces Form 5405, page 2.

- Your client's credit has been tracked if data appears in Year home purchased and Amount of credit taken.

- If that data is incorrect, delete the HOME screen and reenter it as you would for a new client.

- For new clients, Drake calculates the repayment if you complete the following fields on the HOME screen:

- Date home was purchased

- Original credit from Form 5405

- Amount of original credit repaid in prior year (this is the total repaid in prior years)

Your client can obtain this information using the IRS First Time Homebuyer Credit Account Look-up tool (see First Time Homebuyer Credit Lookup Tool Helps Taxpayers Who Must Repay the Credit for more information). If the taxpayer has questions regarding their repayment or trouble accessing their account, they should contact the IRS at (800) 919-0352.

The repayment appears on:

- Schedule 2, line 10 in Drake21 and future

- Schedule 2, line 7b in Drake19 and 20

- Schedule 4, line 60b in Drake18

- Form 1040, line 60b in Drake17 and prior

The results also appear on Form 5405, Part III or IV (if it is required to be filed):

- Part III shows repayment required due to conversion to another use or sale of the principle residence.

- Part IV shows scheduled repayments of the credit required for a purchase in 2008.

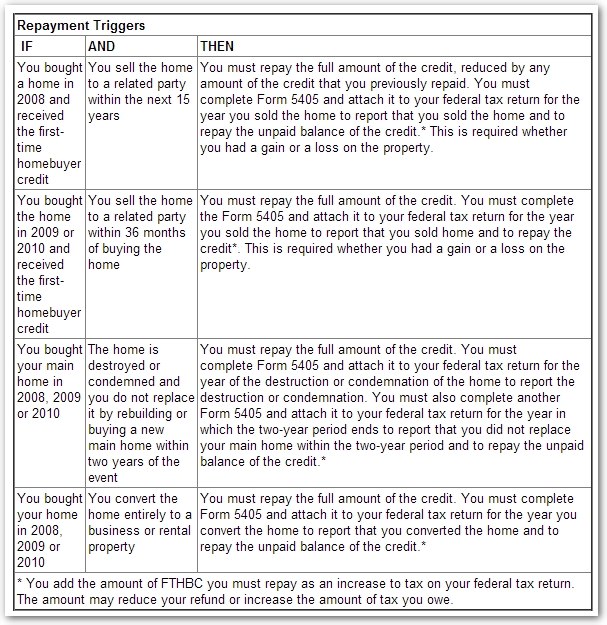

For more information about the Form 5405 filing requirement, go to IRS.gov at First-Time Homebuyer Credit, where the IRS provides this table as a summary:

Form 5405 will not print unless required. There is no way to force the 5405 to print when it is not required. A blank Form 5405 is available under Tools > Blank Forms. See Form 5405 Instructions for more information about repaying the credit.

Repayment Not Produced

If the repayment is not produced, check the:

- Date home was purchased (must be in 2008),

- Original Credit from Form 5405 (or grayed out box Amount of credit taken if updated from last year),

- Amount of original credit repaid in prior years.

Home Foreclosure

Enter the event as a sale on the HOME screen, using the applicable foreclosure numbers. Do not use the field Date home ceased to be main home if not sold. See Publication 523, Selling Your Home, for more information.

Death of a Spouse

If one spouse dies, the deceased spouse's half of the remaining (unpaid) credit is forgiven. The surviving spouse's repayment obligation is then based on the outstanding balance after the forgiveness. In other words, the surviving spouse remains responsible for the surviving spouse's half of the credit.

"Example: Taxpayer A and B are married. They bought a home together in 2008 and claimed the credit on a joint return. They received the $7,500 credit and repaid $500 each year for 2010, 2011 and 2012. Taxpayer A dies in 2013. Are repayments waived?

A. Taxpayer A’s half of the remaining credit is forgiven, and Taxpayer B now is responsible for only her half of the remaining credit, or $3,000. Now, Taxpayer B is required to repay only $250 a year, beginning with her 2013 tax return."

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!