If I don’t use Form 4562, can I get Form 8829, Office in Home, to figure depreciation for business use of a taxpayer’s home?

You can enter depreciation data either on screen 4562 and point it (using the For box) to 8829, or you can enter the data directly on screen 8829.

Caution: If your home was placed in service in the current year, and you have section 179 expense from any activity in the return, you must enter home depreciation data on screen 4562 to prevent e-file rejection. See Related Links below.

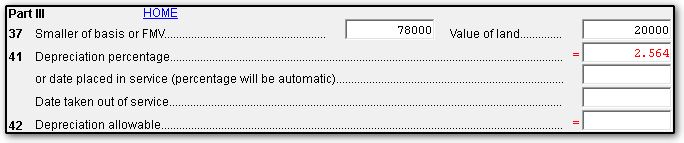

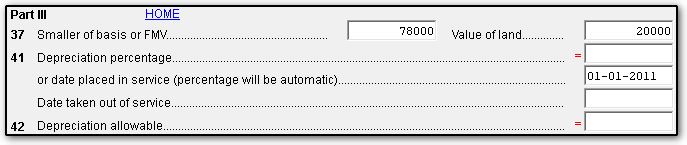

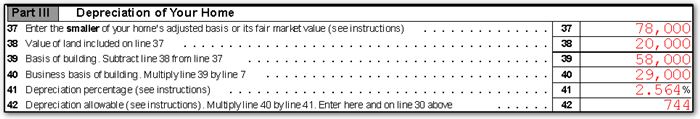

If you omit Form 4562, and want to enter the depreciation directly in Part III on screen 8829, you must enter the basis/FMV/land information required by line 37. You must also enter either (1) the depreciation percentage (an override field), or (2) the date the home was placed in service, on line 41 for the software to perform the computation and complete Part III of the form. The software will calculate the correct depreciation percentage from the data entered, but the override can be used instead if you know the correct percentage rate.

Note: In Drake17 and prior, basis/FMV/land information was entered on line 36 and depreciation percentage and date home was placed in service was entered on line 40.

For example, entering either this,

or this,

produces the same thing in this case:

A different Depreciation percentage than the 2.564% used in the example would override this and produce a different result.

Important: If the taxpayer is depreciating assets in addition to the home itself, enter the home on Form 4562, rather than Part III of Form 8829.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!