How do I set up a return to deposit state refunds?

There are several options in Drake Tax that allow you to customize how your taxpayer's state refund will be received. The following outlines each available method:

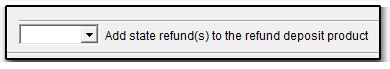

- If the taxpayer is using a bank product on federal, they can choose to add the state refund(s) to the refund deposit product. This allows the bank to process the state refund using the same method chosen for the federal bank product.

- If the taxpayer wants their federal return to be processed with a bank product, but wants the state refund(s) to be directly deposited without the use of a bank product, you will fill out the bank and DD screens, as applicable.

- If there is no bank product being used, the taxpayer can still elect to have their state refund directly deposited into their bank account, or IRA checking, IRA savings, or 529 CollegeAdvantage account, as applicable (limitations apply, not all methods are supported in every state).

See the applicable scenarios below for more details on each option:

1. Bank Product on Both Federal and State(s)

You can choose to have all eligible state refunds directly deposited through a bank product. On the bank screen, select A All States from the drop list Add State... (or from the Republic screen drop list The taxpayer elects to route the refund of the states...).

Banks may charge additional amounts for each state product, and some states may not be eligible.

In view mode of the return, the Transaction Summary provides a listing of the amounts and states involved.

2. Bank Product on Federal, Direct Deposit for State(s)

If the taxpayer has a federal and state refund, and you are requesting the federal refund through a bank product, you can select a different refund method for the state.

First, complete the bank screen for your banking partner located on the General tab under Electronic Filing and Banking in data entry for the federal refund. Leave the State Product field blank:

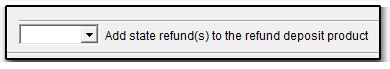

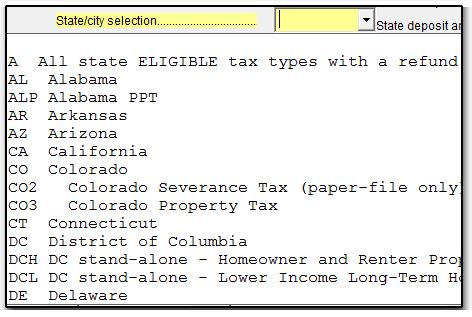

Next, open the DD (Direct Deposit/Form 8888) screen in data entry. Complete the screen with the name of the financial institution, routing, and account number. Be sure to repeat the routing and account number and the type of account to avoid errors. Make a selection of N in the Federal selection drop list, and select the specific state, as shown below:

Notes:

- If you do not see your state in the drop list, that state may not allow refunds to be directly deposited. Please choose a different refund method.

- If you do not make a selection, no state refunds will be set up for direct deposit.

- Check the Transaction Summary in view mode to verify amounts being deposited and for which state.

- If you have multiple state refunds, please select A All state eligible tax types with a refund NOT indicated elsewhere in the State/City selection drop list.

3. Splitting a State Refunds (No bank product)

Generally, you cannot split state refund direct deposits between two or more accounts. That is why the State deposit amount override field is grayed out by default. This field is an override field that will pull the calculated refund amount to be direct deposited.

Multiple States

If there is more than one state to be direct deposited into a single account, choose A in the State/city selection box. This will indicate that all states who are not chosen to be refunded in a different manner will be deposited into a single account.

You can choose to have different state refunds deposited into different accounts, if desired. To do this, enter the first state abbreviation in the Account #1 section and complete the required fields. Enter the second state abbreviation in the Account#2 section and complete the relevant fields.

Exceptions

Two states, California and Maryland, do allow the direct deposit to be split. When CA or MD are selected in the state/city selection field, the State deposit amount field is enabled for override.

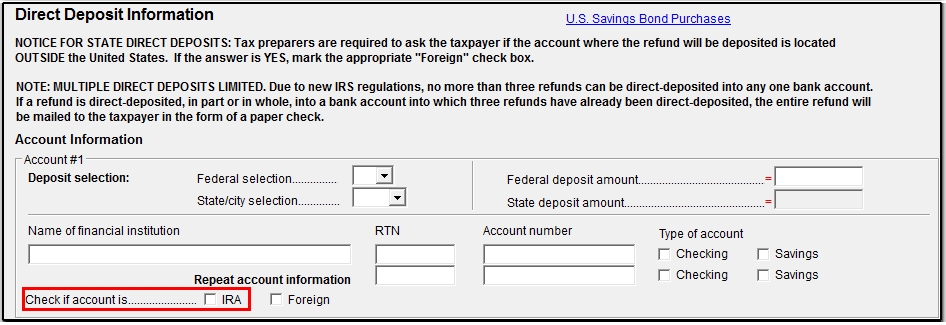

In addition to a bank account, Ohio refunds can be deposited into multiple IRA checking, IRA savings, or 529 CollegeAdvantage account.

- To deposit into an IRA checking or savings account, check the box IRA on the federal DD screen:

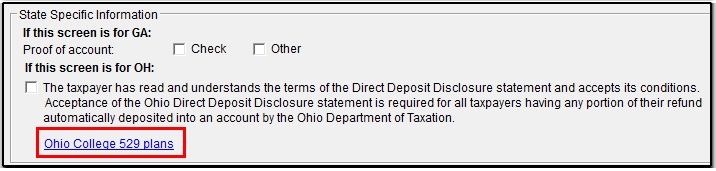

- To deposit a refund into a CollegeAdvantage 529 account (max. 3), click the Ohio College 529 Plans link at the bottom of the federal DD screen:

In addition to a bank account, New York refunds can be deposited into a College 529 plan.

- To deposit a refund into a College 529 account, click the NY College 529 Plans link at the bottom of the federal DD screen:

Be sure to review the Transaction Summary in view mode to ensure that the refunds are scheduled to be processed as the taxpayer desires. State transaction information may not be displayed on the Transaction Summary (even if properly set up) if there are red messages for federal or that state.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!