What entries are available for 179 expense? Are there limits?

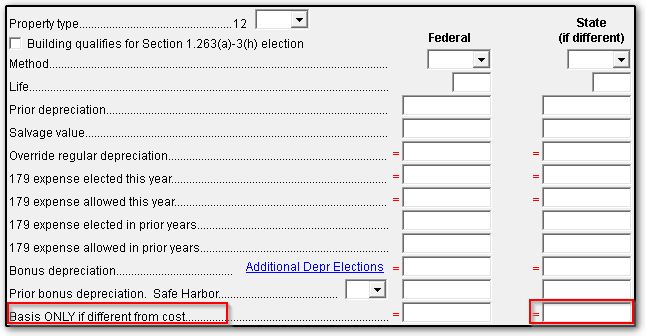

Screen 4562

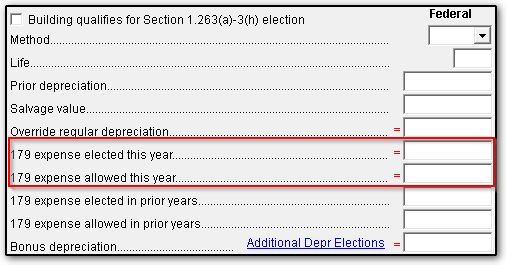

179 expense elected this year (override)

If EXP is used as the method of depreciation, the system expenses the entire cost of the item up to the allowable yearly limit and will carry forward any remaining amounts for future years.

If the taxpayer elects to expense only a portion of the cost, the depreciation method and life should be entered and the amount elected for 179 expensing should be entered in 179 Expense Elected This Year.

There are two basic limits to the Section 179 deduction.

- The maximum amount (Form 4562, line 1) changes yearly. Taxpayers cannot elect more than that. If EXP is used as the method of depreciation and the taxpayer attempts to elect more than the maximum amount allowed, the system will limit the election to the maximum amount allowed. Data entry will need to be changed to the correct depreciation method and life, and the limited amount entered in the 179 Expense Elected this year field. There is nothing to carry forward.

- The business income limitation Form 4562, line 11 varies based upon the taxpayer’s income and expenses on the current-year return. Taxpayers can only deduct 179 expenses up to the business income limitation. Any portion elected (up to the yearly limit) that cannot be deducted in the current year due to the business income limitation will be carried forward.

EF Messages 1043 (1065), 1143 (1120/1120S), or 5623 (1040) are generated if either the maximum amount of section 179 expense allowable has been exceeded, the luxury vehicle depreciation limits have been exceeded, or the amount in "179 expense allowed this year" doesn't match the cost. To resolve this message, select another method of depreciation (such as SL, M, etc.) and enter the expensed amount in the 179 expense elected this year field.

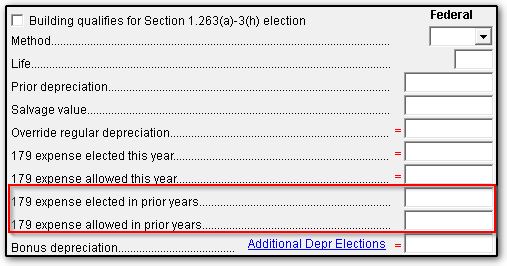

Section 179 Expense Elected In Prior Years and Section 179 Expense Allowed In Prior Years

These fields can be used to directly enter information about a prior year 179 election for an asset. When you update a return with 179 expense, these fields will show the 179 that was elected/allowed in the prior year for that asset. An entry here prevents any further Section 179 expensing from being taken in the current year, or carried forward for use in future years. The software views each added asset on the 4562 screen as a new asset. When you add assets in the software which are prior year assets for which Section 179 was taken, be sure to use both fields to stop the software from calculating an additional 179 expense amount. For first-year filers using the system, all prior Section 179 expense information must be entered manually for the depreciation to calculate correctly, especially if another method was used to calculate depreciation.

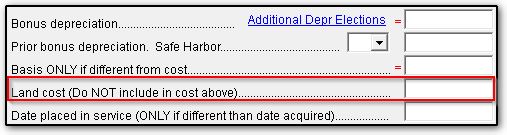

Land Cost

If the depreciable asset is a building, enter the land value (cost) here for tracking purposes. The land value should not be included in the cost field (because land does not depreciate). Do not enter LAND as the first word in the description field or the software will not calculate depreciation. For example, enter BUILDING AND LAND rather than LAND AND BUILDING. See Related Links below for more details on description wording.

An alternate method is to enter the building and the land as separate assets, selecting NDA (non-depreciable asset) as the method for the land entry.

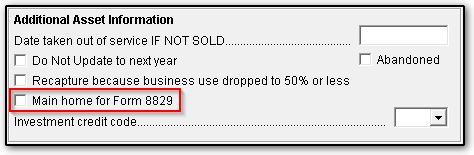

Main Home For 8829

Check this box if this is the main home for the 8829. This causes the information to be posted to the bottom of the 8829 when it is printed.

Additional $5,000 Deduction (Direct entry)

Select Elect additional first-year deduction to allow the extra $5,000 deduction allowed in the first year of amortization in startup costs.

State Basis (If Different) (Override)

If the state depreciable basis is different than the federal depreciable basis, enter the state basis here.

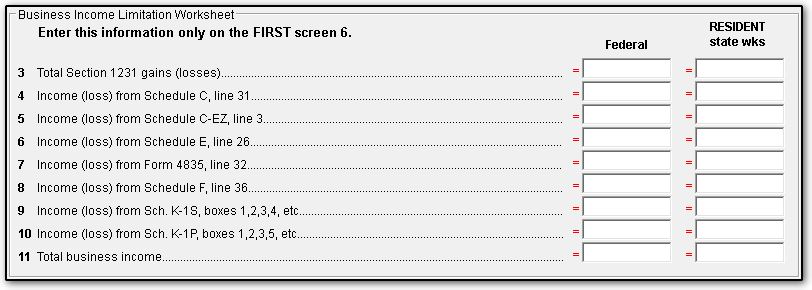

Business Income Limitation Worksheet

Overrides are available for the Business Income Limitation Worksheet on screen 6, accessible from the Income tab under the Depreciable Assets section.

Section 179 Business Income Limit Worksheet (DEPR - Wks 179 Limit in Drake20 and future, Wks 179 Limit in Drake19 and prior)

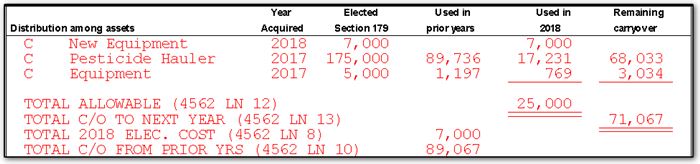

This worksheet calculates the business income limitation and indicates at the bottom of the worksheet how that amount is distributed among the elected Section 179 assets. Note: A separate DEPR - Wks 179 Limit will generate for the resident state calculation of Section 179 deductibility.

If the elected Section 179 asset amounts are not used in the current year, they are carried forward into the next year’s program to be used next year.

After examining the worksheet, you may decide to return to the 4562 screen and change to a different depreciation method, expensing only the allowable amount and depreciating the remainder. This may give you more deductions in the current year.

If you have more than one activity (for example, two Schedules C and a Schedule E) each with Section 179 expense in the current year, the software will produce a Form 4562 with the title Section 179 Summary under Business or activity to which this form relates, then a Form 4562 for each activity. The Section 179 Summary 4562 will appear first and will be sent first electronically.

If you have only one activity reporting Section 179 expense, the 179 expense will be produced on the Form 4562 for that activity.

Section 179 Expense Maximum Deduction Amounts By Tax Year

| 2023 |

$1,160,000 |

$2,890,000 |

| 2022 |

$1,080,000 |

$2,700,000 |

| 2021 |

$1,050,000 |

$2,620,000 |

| 2020 |

$1,040,000 |

$2,590,000 |

| 2019 |

$1,000,000 |

$2,500,000 |

| 2018 |

$1,000,000 |

$2,500,000 |

| 2017 |

$510,000 |

$2,030,000 |

| 2016 |

$500,000 |

$2,010,000 |

| 2015 |

$500,000 |

$2,000,000 |

| 2014 |

$500,000 |

$2,000,000

|

| 2013 |

$500,000 |

$2,000,000 |

| 2012 |

$500,000 |

$2,000,000 |

| 2011 |

$500,000 |

$2,000,000 |

| 2010 |

$500,000 |

$2,000,000 |

| 2009 |

$250,000 |

$800,000 |

| 2008 |

$250,000 |

$800,000 |

| 2007 |

$125,000 |

$500,000 |

| 2006 |

$108,000 |

$430,000 |

For more information on Section 179 maximums, visit the IRS website for prior-year forms and review the instructions for each year: Prior Year Forms & Publications - Form 4562 as well as Publication 946 for the applicable year.

Note: Screen 6 should not be used to indicate 179 expense for multiple schedules. Use it only as an override screen if calculating depreciation from a third party program. In most cases, 179 expenses should be entered on the 4562 screen.

Section 179, Part III, Subsection B

If the amount on line 1 of Form 4562 is over the allowable maximum, the software does not carry the remaining cost to Form 4562, Part III, Section B. When EXP is used as the method, and it exceeds the limit, you must determine how you want to depreciate the balance of the basis of the asset. On the 4562 detail screen, select the method that should be used to depreciate the asset after expensing the allowable amount. In the 179 expense elected this year field, enter in the maximum allowable 179 amount.