Where can I find the IT-201/203X amended income tax return for New York?

Select NY from the States tab. The amended return screens are located on the Other tab.

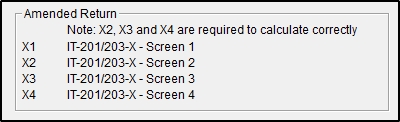

Complete the X1 screen. Then, complete screens X2, X3 and X4, using the autofill functions if information previously exists, to pull amounts from the original return.

Filing the amended return

The New York Individual part-year and nonresident amended returns can be e-filed. The IT-201X and IT-203X are available selections on the EF Selections screen using the drop list selection NY.

We recommend that you archive the return prior to amendment. To archive, go to View/Print mode of the return. Click the Archive button in the toolbar at the top and select Archive Client Return from the drop list. Name and save the archive. The return can now be restored at any time from the Archive Manager. See Related Links below for more information on this process.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!