Can I e-file a state estimated tax voucher and make estimated tax payments from Drake Tax? How do I set that up?

The following table lists states for which ES direct debit payment authorization can be transmitted from Drake Tax. To do this you will go to the ES screen to schedule state direct debits. Note that some states require debit payment information to be transmitted with the return and some require it to be transmitted separately.

| State Estimated Tax - e-File and Direct Debit Supported |

|

STATE

|

Packages Supported

|

Must be Transmitted with the return

|

Must be transmitted separately

|

Can I print Mail in ES Vouchers instead of e-filing them? |

|

AK

|

C

|

Yes

|

No

|

Yes

|

| AR |

I,C,S,P,F |

Yes |

No |

Yes |

|

CA

|

I, C, S, P

|

Yes

|

No

|

Yes

|

| CO |

I |

No |

No |

Yes |

|

CT

|

I,C,F

|

No

|

Yes

|

Yes

|

|

DC

|

I,S,P,F

|

No

|

Yes

|

Yes

|

|

FL

|

C,S |

No

|

Yes

|

Yes

|

|

IA

|

I,C

|

No

|

Yes

|

Yes

|

|

IL

|

I

|

Yes

|

No

|

Yes

|

|

IL

|

C

|

No

|

Yes

|

Yes

|

|

KS

|

I

|

Yes

|

No

|

Yes

|

|

KY

|

I

|

Yes

|

No

|

Yes

|

|

MD

|

I,C,S,P

|

No

|

Yes

|

Yes

|

|

ME

|

I,C,F

|

Yes

|

No

|

Yes

|

|

MN

|

I

|

Yes

|

No

|

Yes

|

|

NC

|

I,C

|

Yes

|

No

|

Yes

|

|

ND

|

I,C,F

|

Yes

|

No

|

Yes

|

|

NE

|

I,S |

Yes

|

No

|

Yes

|

| NY |

I, F |

No |

Yes |

Yes |

| NJ*** |

I, F, C, S, PTE |

|

|

|

| OH |

I |

Yes |

No |

Yes |

|

OK

|

I,C,S,P,F

|

Yes

|

No

|

Yes

|

|

PA

|

I,S,P,F

|

Yes

|

No

|

Yes

|

PA

RCT-101 |

S |

Yes |

No |

Yes |

PA

20S65 |

S,P |

No |

Yes |

Yes |

|

TN F&E

|

I,C,S,P

|

No

|

Yes

|

Yes

|

|

WI

|

I |

Yes

|

No

|

Yes

|

| VA |

I |

Yes |

No |

Yes** |

| VT |

I |

No |

Yes |

Yes |

*Can be transmitted with or without the return.

**See Related Links below.

***I and F: no e-file mandate. C, S, and PTE: e-file required.

Select the e-File check box and press F1 to go to the field help for a comprehensive list of state estimate vouchers that can be transmitted with or without the return in each tax package.

State e-File Direct Debit ES Voucher Setup

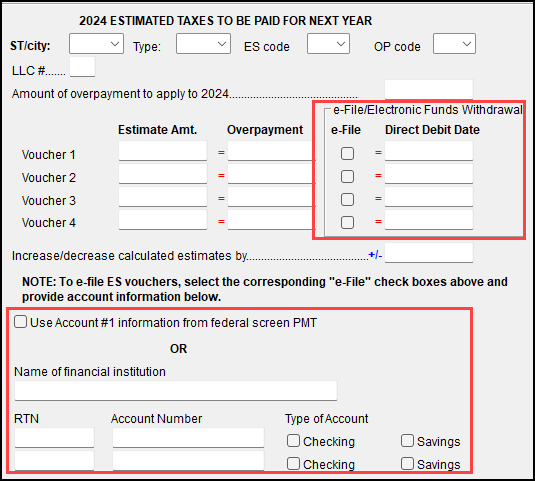

The ES screen has been redesigned to facilitate the e-filing of state estimated tax payments and vouchers, now required by some states.

To e-file state ES vouchers, under 20YY Estimated Taxes to be Paid for Next Year in the State and City Section of the screen, mark which voucher to transmit in the e-file column (shown below). To choose a date other than the due date for authorization of the direct debit, enter a date in the override field.

You can choose to have payments debited from the Account #1 information entered on the PMT screen, or from a new bank account entered on the ES screen.

If the taxpayer needs to make payments to more than one state, press Page Down to get a new ES screen.

Notes:

- Scheduled transactions will be shown in view mode on the Transaction Summary page (formerly DD_PMT).

- If you complete the ES screen for direct debit payments to a state, and there is no indication that the payments are scheduled, check to ensure that the state to which you are e-filing the return accepts them.

- If a state does not allow e-filing of that estimate, a red message will produce in view on that state.

- Some states that allow direct debit of ES vouchers also print a watermark that reads 'This Voucher is Scheduled to be Direct Debited on xx-xx-xxx. Do Not Mail.' (where xx-xx-xxxx is the due date of voucher) over the printed voucher once the selection is made.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!