Choose from the following Merchant Card Processing (E-Pay) Frequently Asked Questions:

- What is E-Pay?

- Is there a cut-off date for applying for EPS E-Pay?

- Do I have to offer bank products through EPS to use the E-Pay feature?

- How do I sign up to use the E-Pay feature through Drake Tax?

- Where on the Support website do I enter the API Login ID and Transaction Key?

- Where do I enter a client's credit card information in a return?

- Why can I not change the Amount Due field on the E-Pay dialog box?

- What if the Amount Due does not match the Bill?

- Can I use the E-Pay dialog box inside the program for charges unrelated to DrakeYY, such as prior year Drake Software returns?

- Why is there a Taxpayer Email field on the E-Pay dialog box?

- When I click the E-Pay icon in a return, a message says I am not currently registered to accept credit card payments through E-Pay, but I was approved and I activated my account.

- What documents or receipts are produced by a transaction?

EPS Merchant Services Main Support:

QuickCommerce / Authorize.net Gateway support:

- Log in to your gateway Merchant Interface and click the Live Chat button located in the upper right hand corner. Or click the Contact Us button located next to the Live Chat button and select Create a Merchant Support eTicket.

- Phone: 877-447-3938

What is E-Pay?

E-Pay is a credit card processing feature offered by EPS that enables your tax office to process transactions from within Drake Tax for any fees for tax return preparation on the taxpayer's bill.

E-Pay is a low-cost Merchant Services option designed for the tax professional – you can accept credit card payments year round, but only pay monthly fees during tax season.

It’s integrated with Drake Software, setup is free, and it’s tailored for your tax business. If you already offer a credit card payment option, compare E-Pay’s low rates to your current service agreement to see if E-Pay can save you money.

E-Pay is offered by EPS Financial, LLC.

To learn more, at contact an E-Pay Specialist at merchantsales@EPSfinancial.net or 844-244-1787.

Watch the video E-Pay for a demonstration.

(back)

Is there a cut-off date for applying for EPS E-Pay?

There is no cut-off date for applying.

(back)

Do I have to offer bank products through EPS to use the E-Pay feature?

No. You can use E-Pay without regard to a bank product, if any, that you might be offering.

(back)

How do I sign up to use the E-Pay feature through Drake Tax?

To sign up, log in to the Support website, select Products from the left menu, and then E-Pay Card Processing from the drop menu. Read the description for each program that is offered and then click the blue Apply button for the program that you want to use:

- E-Pay Simple Fee Program

- E-Pay Monthly Fee Program

Complete and Submit the application. EPS will contact you and either Approve or Decline/Reject your application. On approval, you will receive an email with set up details (if you did not receive the email, contact EPS Merchant Services (844) 244-1787). When that process is completed and your account is ready for use, log into the Support website and enter the API Login ID and Transaction Key supplied to you on the Account > Account Info tab.

(back)

Where on the Support website do I enter the API Login ID and Transaction Key?

On the Support website Account Info page under Company Information, mark the option Is an EPS Merchant Processor. Marking the option displays two fields in which to enter this information. Note: this section of the Account Info is only shown after an application is approved.

Note: the API login ID and transaction key are only entered if you are using the ePay Monthly Fee Program.

(back)

Where do I enter a client's credit card information in a return?

In the return, click the E-Pay icon on the toolbar. The E-Pay dialog box opens. Click the Keyed Credit Card tab to directly enter the credit card data.

(back)

Why can I not change the Amount Due field on the E-Pay dialog box?

The Amount Due field is the total that appears on your client's Bill in view, however, you can alter the Amount to Pay, which determines what is actually charged to the client's card.

(back)

What if the Amount Due does not match the Bill?

The return may need to be calculated. If the Amount Due does not match the Bill, exit the E-Pay dialog box and calculate the return. Return to the E-Pay dialog box and confirm that the Amount Due now matches the Bill.

(back)

Can I use the E-Pay dialog box inside the program for charges unrelated to DrakeYY, such as prior year Drake Software returns?

No. You must go directly through the Gateway for any other charges.

(back)

Why is there a Taxpayer Email field on the E-Pay dialog box?

If using the traditional ePay Monthly Fee Program, when a taxpayer credit card transaction is processed, a receipt is e-mailed to the e-mail address displayed in that field (this option is turned on by default on the Merchant Interface). When you open the E-Pay dialog box, the taxpayer's email address from screen 1 is displayed in the Taxpayer Email field, where you can delete it if the taxpayer doesn't want an email, or change it. If there's no email address on screen 1, the field is blank and you can enter an email address provided by the taxpayer.

If using the ePay Simple Fee Program, an emailed copy of the receipt is not automatically sent to the taxpayer. A two-page PDF is displayed on the screen, consisting of both Merchant and Client receipts, and can be printed. A copy of both receipts is also stored in Drake Documents (DDM). You can use the integrated email function to send the taxpayer a copy of their receipt via email, if needed.

(back)

When I click the E-Pay icon in a return, a message says I am not currently registered to accept credit card payments through E-Pay, but I was approved and I activated my account.

You have not entered your API Login ID and Transaction Key in the Support website.

(back)

What documents or receipts are produced by a transaction?

After a transaction is processed, a two-page PDF is displayed on the screen, consisting of both Merchant and Client receipts, and can be printed. A copy of both receipts is also stored in Drake Documents (DDM), where they can be printed later, if needed.

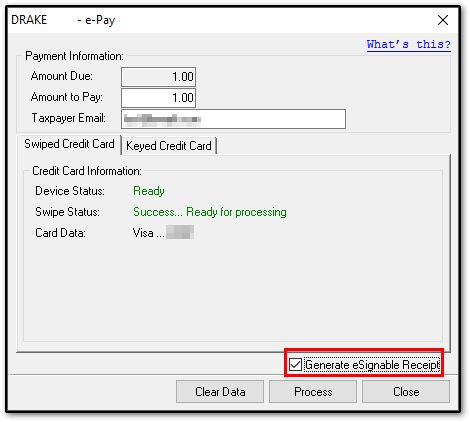

If you have a signature pad, you can also check the box to Generate eSignable Receipt on the E-Pay window. After the payment processes, this will then launch the Drake e-Sign process so that an electronic signature can be applied.

(back)

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!