Why does an amended Louisiana 540X show “Taxpayer Copy -- Do Not Mail” on the top of the form?

Louisiana uses the “Check the Box” method for amending both the IT-540 and the IT-540B.

When you complete an amended Louisiana resident individual return:

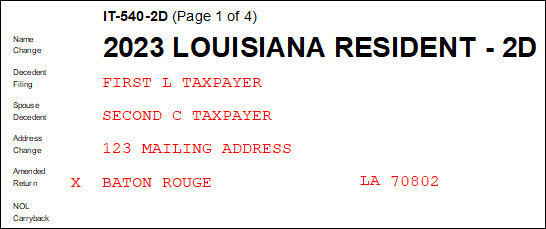

- LA form IT-540-2D (LA540 in View) is produced and marked "Amended Return" on page 1.

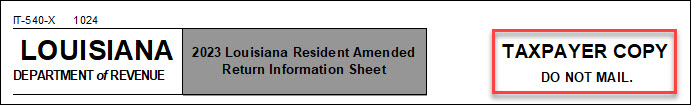

- LA form R-540X (LA540X in View) is produced with the header "TAXPAYER COPY DO NOT MAIL". This document is the "Louisiana Resident Amended Return Information Sheet". It is a worksheet generated by the Drake software program for the taxpayer's records only. Do not mail it to the LA DOR.

When you complete an amended Louisiana part-year or nonresident individual return:

- LA form IT-540B-2D (LA540B in View) is produced and marked "Amended return" on page 1.

- A "Louisiana Nonresident and Part-Year Resident amended return Information Sheet" (LA540B-X in View) is produced with the header "Do not mail. Taxpayer information copy". This is a worksheet for the taxpayer's records only and should not be mailed to the LA DOR.

Note: See FAQ K in LA data entry for help preparing an amended return.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!