Is it possible for copies of Forms 1099-MISC, 1099-G, and W-2G to be generated in Drake Tax for states that require them for e-filed returns?

Several states require the source documents for e-filed returns that include:

- miscellaneous income on Form 1099-MISC,

- unemployment compensation on Form 1099-G,

- or gambling income on Form W-2G.

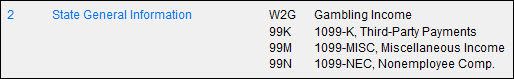

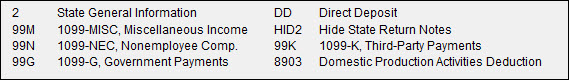

This income can be entered in Drake on screens listed at the bottom of the States tab:

- Screens W2G and 99M on 1065, 1120, and 1120S returns.

- Screens 99M or 99G on 1041 returns.

On the 99M, 99G and W2G screens, only state tax withheld on the screen flows to the state form. No data entered on these screens flows to the federal form.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!