I need to complete a FAFSA (Free Application for Federal Student Aid) for a taxpayer. Can I complete the FAFSA application within Drake?

While the FAFSA application cannot be completed in the software, you can print a FAFSA worksheet to assist in the preparation of the FAFSA application.

This worksheet assists you in collecting and organizing financial information necessary for the completion of the application itself. Note that the top of the screen indicates to which year the worksheet applies. For example, the FAFS screen and Wks FAFSA in Drake Tax are used to complete the 2023-2024 FAFSA Application.

The FAFSA worksheet is not part of the FAFSA application and cannot be filed with a return. It is a guide to completing the application online. It should not be submitted to Federal Student Aid.

To generate a FAFSA worksheet:

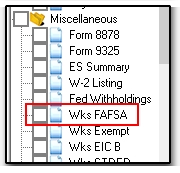

- In data entry of the 1040 return, open the Miscellaneous tab.

- Open the FAFS screen and fill out the applicable information. If necessary, use the override fields to make adjustments.

- Go to View and look for the Wks FAFSA.

Use the information collected on the Wks FAFSA to assist in completing and submitting the FAFSA application (at the Federal Student Aid website, https://studentaid.gov/h/apply-for-aid/fafsa).

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!