Frequently Asked Questions about Ohio Regional Income Tax Agency (RITA) Returns

How do I override Section A (wages and withholding)?

Due to the strict nature of RITA calculation and e-file requirements, Section A (and many other lines on the return) cannot be overridden directly.

Section A contains an amount as "City Not Listed."

Taxable wages are calculated as the highest of boxes 1, 5, or sum of boxes 18 on the W-2. If box 1 or 5 is the highest amount, the difference between that amount and the sum of boxes 18 is carried to Section A with a work city of "City Not Listed." For a taxpayer that lived in a RITA city the entire year, this is required to be able to e-file the return.

If multiple W2 screens must be entered for a single W2 form, because there are more than 14 localities associated with that W2, the federal wages must be allocated between all of the screens entered to prevent an invalid amount of “City Not Listed” wages. The federal wages on each screen must match the total amount of local wages entered on that screen, if possible. In some cases, there may be more federal or local wages reported and one screen will not match totals exactly. If the total federal wages are greater than the total local wages, the amount reported as “City Not Listed” should be the difference between those two and would be correctly included on the return.

The wages for a city are split into two lines on the OHRCTR~ worksheet (R.I.T.A. Credit Limit Computation) and one line does not get a credit.

The employer did not withhold enough tax for the work city (wages multiplied by the work city tax rate). Therefore, the taxpayer can get a credit only for the amount of wages on which tax was correctly withheld. The unwithheld portion of wages is listed on the second line for reference.

How do I indicate that wages were earned during a specific period of time and not all year?

Use the Federal W-2 data entry screen tab Ohio. This screen offers a point of entry for the beginning and ending dates of employment for the corresponding locality entered on the first tab of the W-2 as well as the Additional Entries tab.

How do I complete a part-year RITA return?

Go to OH screen RITA and enter:

- the Date of move

- Enter (at least one is required)

- the RITA city moved from if the taxpayer lived in a RITA city during the first part of the year

- the RITA city moved to if the taxpayer lived in a RITA city during the last part of the year

- the Prior Address where the taxpayer lived before the move.

If any of the wages were earned during a specific part of the year, enter the dates of employment for each W-2 on the W2 screen (see above). If dates are not entered, the program will assume all wages were earned throughout the entire year and divide them up proportionally based on the moved date.

If any non-wage income needs to be entered or allocated to a particular period of residency, OH screen RITJ can be used.

Can I print more than one form for the Regional Income Tax Agency (RITA) in Ohio?

There is no limit on the number of cities that can be entered on the same RITA form and e-filed or mailed together. A separate form for each city is not necessary.

How can I suppress the RITA from e-filing?

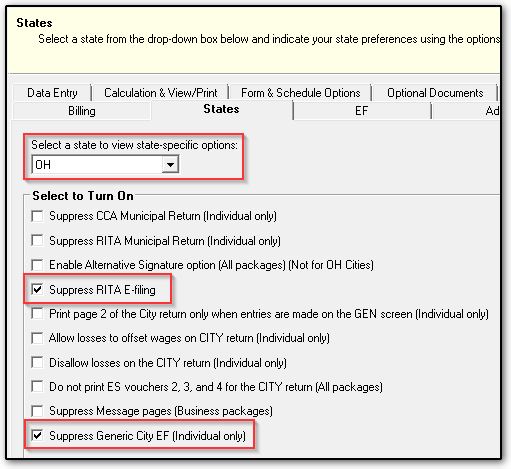

To suppress e-Filing of the Ohio RITA return on a global basis, from the main screen of Drake Tax select Setup > Options > States tab > Select OH from the drop list. Check the box Suppress RITA E-filing. Click OK at the bottom of the screen to save your changes.

Business Returns - Different NOL for Different Municipalities

If different amounts of NOL need to be taken in different municipalities on OH RITA Form 27 (in a business return), go to the RITA screen and select the box Check this box if utilizing different NOL amounts for different municipalities.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!