How can I confirm the amount that is showing on Wks CARRY for State/Local taxes paid in 20YY to flow to the Schedule A?

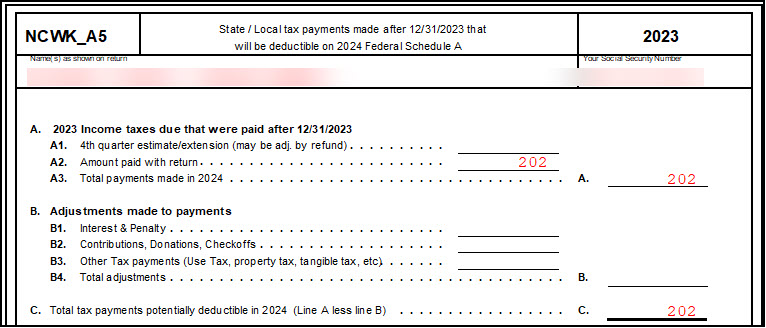

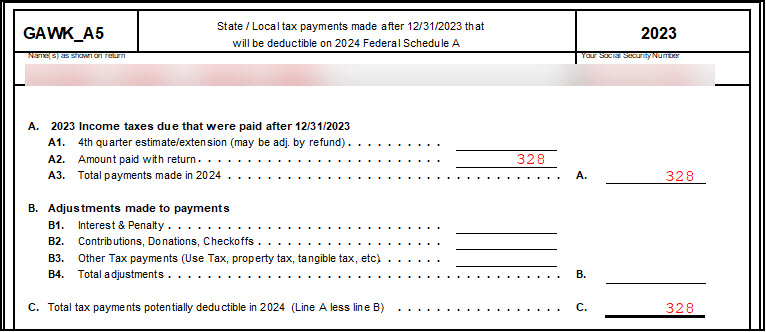

Review state worksheet STWK_A5 where ST is the state to which taxes were paid. For example, if the taxes were paid to North Carolina, and will be deductible on the following year's return, you would review NCWK_A5 in view mode.

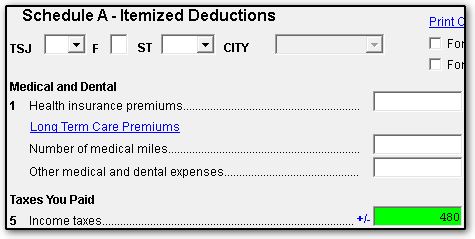

This amount will update to next year's return, Schedule A, line 5 and be flagged (in green) for review. You should verify this amount for accuracy in the updated return. It is the preparer's responsibility to determine whether the client can deduct the full amount that carries to Schedule A, line 5 from the prior year.

For more information about deducting state/local taxes, see the Schedule A instructions.

Multi-State Returns

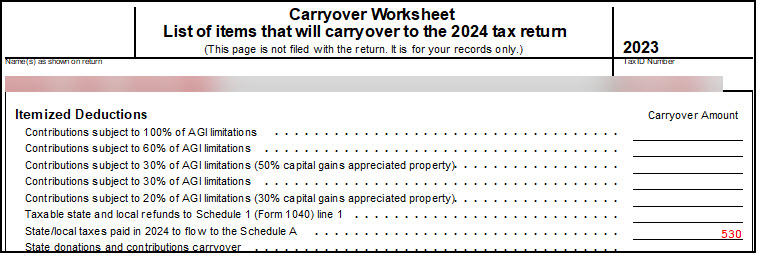

If this is a multi-state return, you must review the WK_A5 for each state in order to reconcile the total amount showing on Wks CARRY. For this example, there are two states, NC and GA. Wks CARRY shows that an amount of $530 in taxes were paid in 20XX and will flow to the Schedule A on the 20YY return. This is figured by adding the amounts from NCWK_A5, line C, $202, to the amount from GAWK_A5, line C, $328.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!