How can I suppress Michigan Form 2210 form producing in View/Print mode?

The Michigan Form 2210, Underpayment of Estimated Income Tax, is used to determine if you owe penalties and/or interest for failing to make estimated payments or for underpaying the estimated tax due.

Per the MI 2210 Instructions:

"Because this is a complicated form, you may choose to have Treasury compute your interest and penalty and send you a bill instead of filing the form yourself. If you want

Treasury to figure your interest, complete your MI-1040

form as usual, leaving the interest line blank, and do not

attach form MI-2210. Interest computed on this form and

penalty charged for failing to file or underpaying estimates

will be the same regardless of whether you pay with your

return or if Treasury bills you."

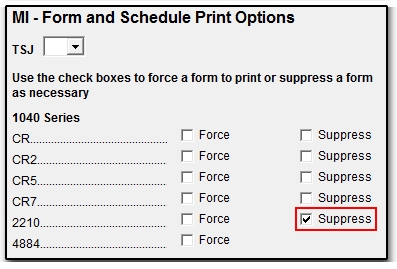

In Drake, if you would like the MI Treasury to compute your interest and penalties for you, you can suppress the form from producing. To accomplish this, from data entry, go to the States tab> MI Michigan> PRNT Print Options screen and select the Suppress check box next to 2210. Checking this box will prevent the Form 2210 from producing in the View/Print mode.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!