Does Drake Tax track charitable contributions that are carried forward?

Beginning in Drake16, charitable contributions that can be carried forward are tracked on the new Charitable Contributions Carryovers screen.

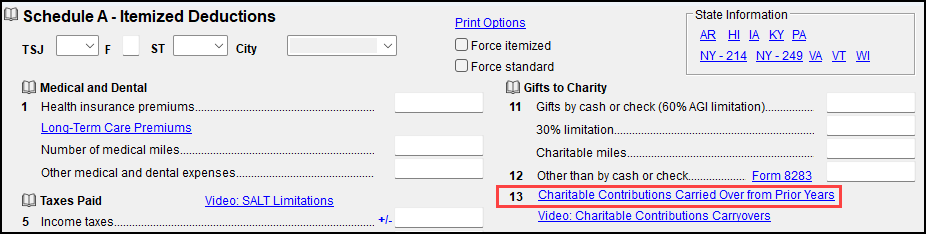

Access this screen by opening screen A - Itemized Deductions Schedule in data entry of the return and clicking the Charitable Contributions Carried over from prior years link on line 13 (line 18 in Drake17 and prior).

Enter the charitable contributions carried forward from previous years on the appropriate line of the Charitable Contributions Carryovers screen. The amounts entered will be calculated and carried to the Wks CARRY carryover worksheet in view mode of the return.

See Charitable Contributions Carryovers for more information.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!