Where do I fill out the Wisconsin Schedule H for the Homestead Credit?

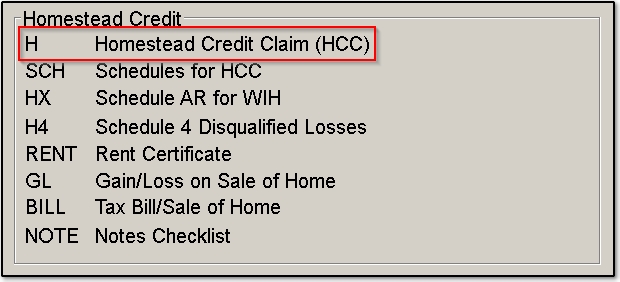

To access the Homestead Credit, you will go to States > Wisconsin. On the right column of the Wisconsin general tab, you will see the H Homestead Credit Claim (HCC) screen. Fill out the applicable information in the H screen, and any other required screens in the "Homestead Credit" section.

See page 4 of the Schedule H Instructions to determine if the taxpayer qualifies for the Homestead Credit. Required documents (such as the rent certificate) can either be attached as a PDF document to be e-filed with the return, or mailed with Form W-RA.

Credit Not Calculating

If the Homestead Credit isn't calculating, you can force the printing of the form to view the calculations. To force the printing of the Schedule H, open the OPT Special Print Options, Including W-RA screen. Check the box to Force Schedule H.

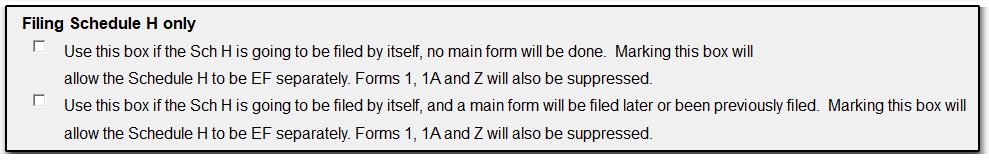

Filing Schedule H Only

Use the check boxes in this section to file the Schedule H only. This will suppress Forms 1, 1A, and Z.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!