Frequently Asked Questions About the Conversion Programs

What is the cost of a conversion program?

There is no charge for the conversion program to our clients or prospective clients.

You can download available conversion programs online after you have received an account login for the support website. If you have not received any temporary account info, contact your sales representative for assistance at (800) 890-9500.

How and when can I get a conversion program for my old tax software?

For new Drake clients and trial software clients:

Full Version Downloads. Available conversion programs for the current and prior tax years can be downloaded at the Drake Support Conversions page. Log in to Drake Support with your User account credentials. Select Downloads from the menu and then select Conversions from the drop list. Select the tax year you want to convert, then you will see a list of programs and instructions for conversion. The conversion programs available for download at Drake Support are always the most current versions.

Installed conversion program updates. You can update your installed conversion program by using the desktop icon that is created when you install it. When you double click the update icon, the software prompts you if an update is available (software version numbers are displayed on the Drake Support conversions page).

If you have not received any temporary account info, contact your sales representative for assistance at (800) 890-9500.

Even if you did not purchase the prior year program, you can still open that program in trial mode to get started and convert your files. For example, if you only purchased Drake23, you are still able to install Drake22 in trial mode and convert files from your prior software provider (where supported). This allows you to review the converted data and then when Drake23 is released, you can simply update your converted files from Drake22 to Drake23 and begin preparing 2023 returns.

What returns and forms can I convert to Drake Software?

Drake converts returns from the following tax software. Conversions for the current filing season are listed on the public Drake Software Conversions page:

ATX™

by CCH Small Firm Services® (1040, 1041, 1065, 1120, 1120-S) |

ProSystem FX®

by CCH (1040, 1041, 1065, 1120, 1120-S) |

TaxWorks®

by RedGear (1040, 1041, 1065, 1120, 1120-S)

(2014 and prior only)

|

Crosslink®

by Petz Enterprises (1040) |

TaxAct®

by 2nd Story Software, Inc. (1040) |

TurboTax®

by Intuit® (1040, files must be sent to Drake for conversion)* |

Lacerte®

by Intuit® (1040, 1041, 1065, 1120, 1120-S) |

TaxSlayer Pro®

(1040) |

UltraTax®

by Creative Solutions (1040, 1041, 1065, 1120, 1120-S) |

ProSeries®

by Intuit® (1040, 1041, 1065, 1120, 1120-S) |

TaxWise®

by CCH Small Firm Services® (1040, 1041, 1065, 1120, 1120-S) |

|

Note: Drake does not convert H&R Block files.

More information about what can be converted is available from the conversion program download list for current and past tax years on the Drake Support Conversions page.

Only one return for each SSN/EIN is converted from the other program. If the other program supports multiple returns for a single SSN/EIN, the last file converted for that SSN/EIN will be the one that is available in Drake Tax. Verify that the intended file was converted properly to Drake Tax.

The following information is available on this web page:

|

Version

|

The software version number; a higher number is a later version.

|

|

Program

|

Link downloads the conversion software for the listed program

|

|

Instructions

|

Link opens a PDF copy of conversion instructions for the listed program.

|

|

Packages Converted

|

Lists the tax packages converted for the listed program. These are links that open the list of forms converted for each tax package.

|

How many assets can I convert?

There is no fixed limit on the number of assets per return that the program converts.

Can I convert state programs?

You can convert only federal returns. If you have installed an appropriate Drake state program, after conversion much of the federal information will automatically flow to the state program. Some state data entry may be necessary to complete the state return.

Conversion Program Installation Requirement

Generally, you are required to have the prior tax software installed on your network in order to successfully run a Drake conversion program. If you do not have the prior tax software installed on your computer, please contact Drake Software conversions at (828) 349-5546 for additional information.

|

Software

|

Required to be installed?

|

|

ATX

|

Yes

|

|

Crosslink

|

Yes

|

|

Lacerte

|

Yes

|

|

ProSeries

|

No

|

|

ProSystem FX

|

No

|

|

TaxAct

|

No

|

|

TaxSlayer

|

No

|

|

TaxWise

|

No

|

|

UltraTax

|

Yes

|

Conversion Programs Do Not Require the Corresponding Year of Drake Tax

No, you do not need the corresponding year of Drake Tax installed to run the conversion programs.

For example, if you are converting your 2022 tax data to bring into the Drake23 program, you do not need to install Drake22 to run the conversion. The conversion program will create the necessary folder structure required to update your returns to the 2023 program.

Note that you can install the prior year program of Drake Tax in trial mode, even if you have not purchased that year of Drake Tax.

We do recommend that you install the corresponding tax year of Drake Tax to open and calculate the returns before updating them to the current tax year's program in order to:

- Verify all data was converted as expected and to make any necessary changes before updating them into the latest version of Drake Tax, and

- Produce the COMPARE worksheet to update to the latest version of Drake Tax.

Conversion of 706, 709, 990, and 1040-NR Returns

Drake Tax currently does not convert 706, 709, 990, or 1040-NR returns for any of the conversion programs. Estate (Form 706), Gift (Form 709), Tax-exempt (Form 990), and Nonresident Alien Income Tax (Form 1040-NR) returns have to be manually entered into the software.

Is there any issue if I have Password-Protected my files in the other program?

No, the data is able to be converted.

Note: the only exception is for a Turbo Tax file. If a Turbo Tax return has been password protected, the password must be removed prior to submitting the file for conversion.

TurboTax Conversion

Drake Tax is able to assist you with converting personal returns (1040) from TurboTax desktop or TurboTax Online. Please indicate which program (desktop or online) was used to create the return when contacting Drake Support for assistance. Drake will convert the TurboTax return into the corresponding year of ProSeries. When you receive the converted files, you must download the ProSeries conversion from the Support website > Downloads > Conversions to finish converting the data to Drake Tax. For detailed assistance with converting your files, call the Drake Software Conversions line at (828) 349-5546.

Important:

- Drake Tax does not convert TurboTax business returns.

- Only the three prior years are available for conversion (2022, 2021, and 2020).

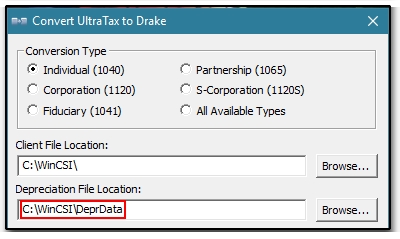

UltraTax Conversion - Missing Depreciation

UltraTax stores their client files separately from their depreciation files. The conversion program will have the default path that UltraTax uses for their depreciation data. If you have changed the path in UltraTax for where the deprecation gets stored, you will need to change the path for the "Depreciation File Location" in the conversion program.

Note: If you have already converted the files to Drake Tax, and the deprecation is missing, you will have to reconvert the files with the proper depreciation path.

If you are using UltraTax on the Cloud, you will need to download both client data and the asset data for conversion. This will result in two separate zipped backup files. The UltraTax program must be installed on the same computer as the Drake conversion software for a successful conversion. Call Drake Software Conversions at (828) 349-5546 for more information.

Important: Depreciation items that are entered into the Ultra Tax fixed asset manager only will not convert.