How do I apply an overpayment to next year in an 1120, corporate return?

In Drake23, use the ES screen to indicate that an overpayment should be applied to the next year by using the OP Code drop list. You can enter or override the installment and overpayment amounts as needed for each quarter. In View/Print mode, ensure that Wks Estimated Tax is showing the necessary amounts. You may need to make entries on screen ESTX to change the Taxable income expected for the tax year or adjust other amounts that are expected to change.

Note: Overpayments cannot be applied unless estimates are being calculated (shown on Wks Estimated Tax). If you choose to apply an overpayment to the next year, make sure that the PRNT screen does not have the selection Do not calculate estimated tax worksheet based on 2023 taxable income marked. If this box is marked, the overpayment information will not flow to the return.

In Drake22, use these steps to apply an overpayment to the next year:

- Use the ES screen to indicate that an overpayment should be applied to the next year in the OP Code drop list.

- Then go to screen ESTX and enter the Taxable income expected for the tax year in line 1.

- This will produce Wks Estimated Tax and indicate that there will be taxable income in the following tax year to allow the overpayment to be applied accordingly.

Note: Overpayments are not automatically applied unless 20YY estimates are being calculated. If you have made the above entries, and the overpayment is not being applied, check to ensure that the PRNT screen does not have the selection Do not calculate estimated tax worksheet based on 20YY taxable income marked. If this box is marked, the Form 1120-W is not calculated and the software will not carry any overpayment information to the return.

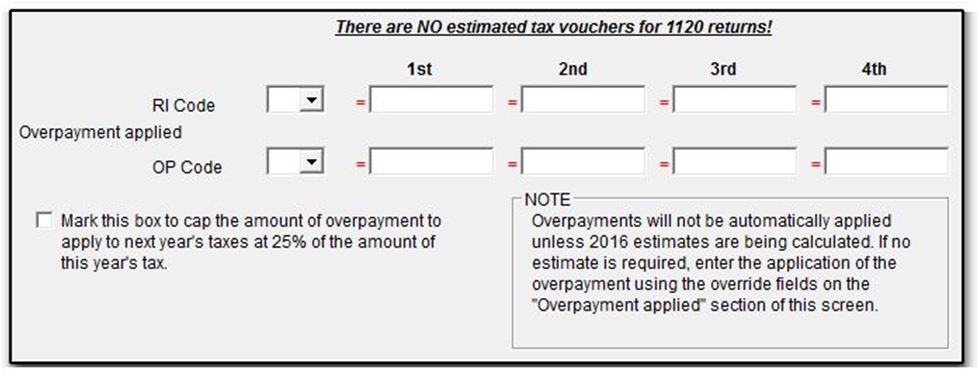

In prior years, use screen W, choose an OP code and enter the refund amount you want to apply in the first quarter field. If you wish to spread the refund over several quarterly payments, enter the partial refund amount for each quarter. There are no estimated tax vouchers in an 1120 return. In view mode, review Form 1120-W and Estimate Summary to see the calculation of estimated tax expected to be paid by the corporation.

If current-year taxable income is not greater than 0 and you want to apply the current-year overpayment to next year, enter a positive amount on line 1, Taxable income expected for the tax year, at the top of screen W. If you have made the above entries, and the overpayment is not being applied, check to ensure that the PRNT screen does not have the selection Do not calculate Form 1120-W worksheet based on 20YY taxable income marked. If this box is marked, the Form 1120-W is not calculated and the software will not carry any overpayment information to the return.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!