On a 4562, how do I enter amortized assets?

Enter the Description, Date Acquired, Cost/Basis, and select an applicable Property Type on the 4562 Depreciation Detail screen.

In the Method field, enter AMT (use a different method if applicable), and enter years amortized in the Life field. If the life is given in months, convert it to years. For example, 60 months would be 5 years.

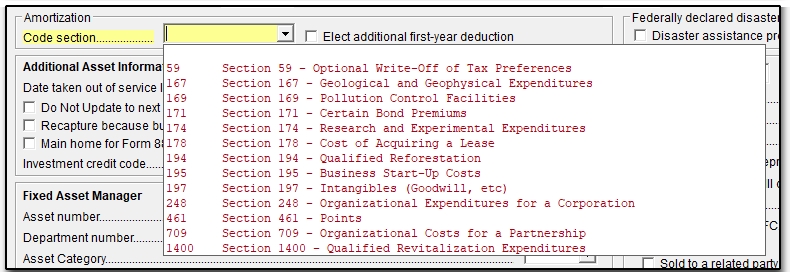

Choose an amortization code section under Amortization Information.

Note: You cannot amortize mortgage insurance premiums on screen 4562. If you do, they will appear on the 2% limitation line rather than the insurance premium line. You will have to manually compute the amount and enter it on the schedule A screen. Once you have computed the amortization schedule, an alternative to help you keep track of them is on the NOTE

screen. On the NOTE screen, you can enter a note that will update to next year and open when the return is opened. See Related Links below.

For steps needed to amortize mortgage points through Drake Tax, see Related Links below.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!