What is Form 990-N and how do I file it?

From Publication 4839, Annual Form 990 Filing Requirements for Tax-Exempt Organizations:

"Smaller tax-exempt organizations—those with annual gross receipts of $50,000 or less may file the Form 990-N (e-Postcard). This notice, which must be electronically filed, asks for only a few basic pieces of information: the organization’s taxpayer identification number, its tax period, legal name and mailing address, any other names used, an Internet address if one exists, the name and address of a principal officer and a statement confirming that the organization's annual gross receipts are normally $50,000 or less.

These organizations also have the option of using Form 990-EZ or 990 if they prefer, as long as they complete the entire form."

For more information about Form 990-N, see the IRS website.

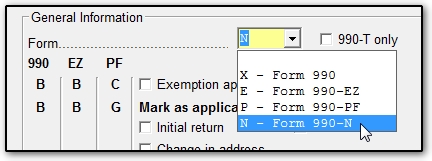

Form 990-N, the e-Postcard, can be generated by selecting N from the Form field drop list on screen 1 of a 990 return:

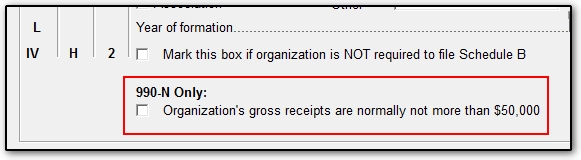

In the lower left corner of screen 1, select the option Organization's gross receipts are normally not more than $50,000.

Go to the OFF screen and complete the Name and Title fields, enter an address (or select the Use entity address check box), and for at least one officer, select Principal officer.

Form 990-N, the e-Postcard, is an e-file only form. Since there is no paper form 990-N, no IRS form is produced in view mode. Drake provides the printout 990-N information detailing the information that is transmitted to the IRS in the 990-N, e-Postcard.

Form 8879-TE is not required for Form 990-N and is not generated in Drake Tax (see table 3-3 in Publication 4163). Note 170 generates explaining this.

If there was a name change for the tax exempt organization, and the organization is eligible to and elects to file Form 990-N, do not check the box Change in Name on screen 1. This box only applies to forms 990-EZ, 990, or 990-PF. If this box is marked, EF message 5065 will be produced preventing e-file of Form 990-N.

IRS added the following information to their page about filing Form 990-N, however, this only applies to those who are not filing Form 990-N through a software vendor. If you are using Drake Tax to file Form 990-N, the form can be e-filed through Drake Tax (steps above) and the charity is not required to sign in to the IRS platform. The statement reads as follows:

"Beginning August 1, 2022, smaller charities that are eligible and choose to file Form 990-N, Electronic Notice for Tax-Exempt Organizations (e-Postcard), must sign into the IRS modernized authentication platform using either their active IRS username or create an account with ID.me, the current IRS credential service provider."

If there are multiple return types in the same 990 return, you may need to use the supplemental letter (see KB 14869) to provide more details to the entity.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!