How do I record a change in ownership when partners exchange profit, loss or capital during the year?

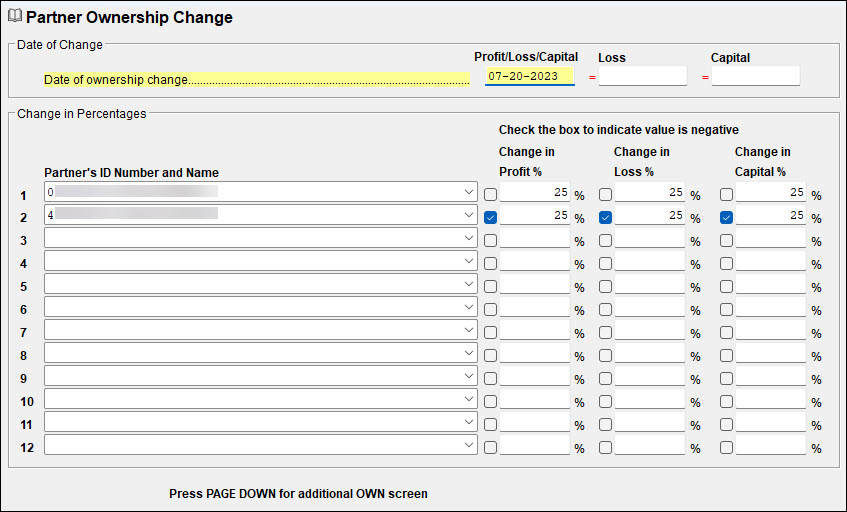

In Drake Tax, partnership ownership transactions are entered on the OWN screen:

- Open the OWN screen and enter the first date of exchange in the Date of Ownership Change section. The date entered must be within the tax year.

- If all three ownership percentages – profit, loss, and capital – were exchanged, then enter the date in the Profit/Loss/Capital field only. If the Profit, Loss, and Capital exchanges occurred on different dates, enter the profit exchange date (if any) in the Profit/Loss/Capital field, and any additional exchange dates for loss or capital in the Loss and Capital date fields.

- Select the partners involved in the exchange from the Partner's ID Number and Name drop list.

- In the Change in Profit % field, enter that partner's change of profit ownership.

- In the Change in Loss % field, enter that partner's change of loss ownership.

- In the Change in Capital % field, enter that partner's change of capital ownership.

- Note: Although only one date is required when the exchange involves all three percentage types, the percentage amount must be entered for each. Use positive numbers to increase the partner's interest; use the check box to indicate a negative number that will decrease the partner's interest.

- Repeat Steps 2-5 for all partners involved in ownership changes. The final sum of changes entered for all partners should total zero, leaving the partnership owned 100%.

- Calculate the return.

- In View/Print mode, review:

- the K-1 Wks Own page for each partner to verify that the percentages are correct. Use the calculated percentage to confirm that the K-1 amount for the partner presents the appropriate amount of income, deductions, etc. (To do so, multiply the Schedule K amount for each line by the calculated percentage.)

- the Wks POWN percentage information for each partner to confirm the correct year-end percentage of ownership for each partner.

- the percentage information printed in item J of each partner's K-1 in order to confirm that the year-end percentages are correct.

Notes:

- The program calculates the percentage changes for as many dates and exchanges as necessary. Press Page Down for a new screen for each date.

- When an exchange involves more partners than one screen can hold, enter the same date in the new screen and continue selecting the partners involved. In this instance the individual OWN screens may not net to zero, but the entire exchange must net to zero.

- The ending ownership percentage may not equal the calculated ownership percentage, as shown in this example:

- Two partners each own 40% of a partnership and a third owns 20%. The 20% partner decides to sell his interest to the other two partners on July 1. The two remaining partners' share of income, loss, deductions, etc., of the partnership is now 45% each for the year-- not 50%. The 45% figure comes from the following equation:

(40% x 181 days/365 days) + (50% x 181 days/365 days)

The partner selling his interest will receive 10% of the partnership's income, loss, deductions, etc., bringing the total allocation to 100%.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!