How do I indicate a self-prepared return, or a return for which no fee was charged?

If the taxpayer brought in the return already prepared and/or there is no paid preparer for this return, a few items need to be completed to indicate this:

- Select NONE Self-Prepared Return (No Paid Preparer) from the Preparer number field drop list on screen 1.

If you are e-filing this return on behalf of the taxpayer, you must still be listed as the ERO on screen 1.

- Go to the PREP screen and mark the box Return was prepared by taxpayer. No fee was charged for preparing this return at the bottom of the screen.

- Complete the PIN screen as the ERO and clear any remaining red messages to prepare the return for e-filing.

Do not force "self" into the Preparer number field. In a business or a personal return, "self" is not a valid entry and generates an EF message advising that preparer information is missing or incorrect.

No PTIN in Setup > Preparers

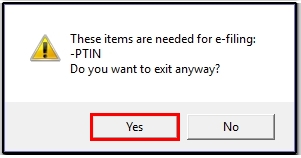

If a preparer does not have a valid PTIN, they generally cannot e-file returns for which they received compensation. When setting yourself up as a preparer under Setup > Preparers, if you do not have a PTIN, you will get the following message:

If you do not have a PTIN, click Yes on the pop-up. Be sure to review the FAQs about PTINs from the IRS to ensure that you are not required to have a PTIN.

Individuals that do not have a PTIN are able to e-file a self-prepared return or a return for which no fee was charged. In Drake Tax, follow these steps to clear this type of return for e-filing:

- Set up a preparer under Setup > Preparers with the following:

- Name.

- Email (if needed).

- Self-employed checkbox (if needed).

- Leave the PTIN field blank.

- Username.

- PIN signature (if e-filing returns with this preparer as ERO).

- Security level.

- Any other applicable fields.

- Click Save.

- On the pop-up about a PTIN being required for e-filing, click Yes.

- Exit the Setup screen and go into the return.

- On screen 1, choose NONE as the Preparer. Ensure that the ERO field has a valid selection other than NONE.

- On the PREP screen, mark the box Return was prepared by taxpayer. No fee was charged for preparing this return at the bottom of the screen.

- Complete the PIN screen as the ERO and clear any remaining red messages to prepare the return for e-filing.

Note: Some states do not allow e-filing if preparer is set to NONE or there is no PTIN entered under Setup > preparers. For example:

Alabama e-filing is disallowed per red message 0088.

Minnesota e-filing is disallowed per red message 0094.

Louisiana generates red message 0027 which requires additional entries on the PREP screen.

Missing Documents

Some documents are omitted when a return is marked as self-prepared.

- The Folder Cover Sheet is essentially a cover sheet for presentation of a preparer's work product to the client. If the taxpayer prepared his or her own return and there is no "paid" preparer, the sheet is not needed and thus does not appear in view mode.

- If a folder cover sheet is desired, temporarily remove the NONE indicator from screen 1 to produce the folder cover sheet.

- Form 8867, Paid Preparer’s Due Diligence Checklist is not produced and is not required when there is no paid preparer.

Charging for e-filing a self-prepared return

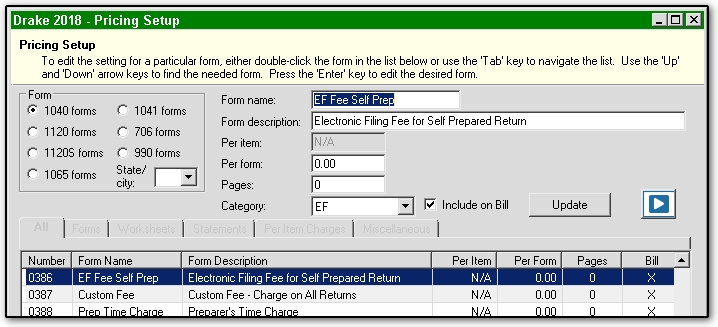

The software contains an item within the Pricing Setup that allows you to set a fee for e-filing a self-prepared return.

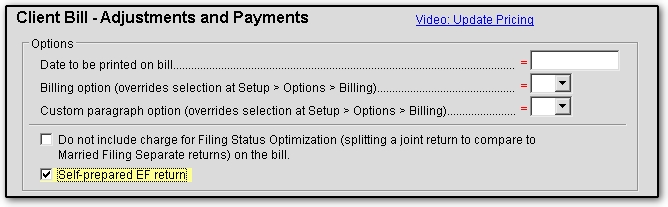

Set up the fee you will charge in Setup> Pricing > 1040 forms for item 0386 (EF Fee Self Prep - Electronic Filing Fee for Self-Prepared Return). Next, go to the BILL screen in the return and select Self-prepared EF return.

Your fee will now show on the Bill next time you view the return.

Bank Products

Generally, you cannot use a bank product on a self-prepared or non-paid return. Some banks provide additional information or entries on their individual bank screens.

Firm Setup

Under Setup > Firms > Settings tab, you can enter a non-paid preparer code. Important! This should only be used if the firm is not a paid preparer. Valid entries include:

- VI - VITA

- VT - VITA-T

- TE - TCE-X

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!