How do the fee overrides on Screen 1 and the bank screen work?

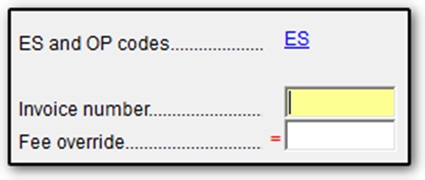

Screen 1 Fee Override

The Fee Override on Screen 1 overrides the Forms Subtotal on the bill.

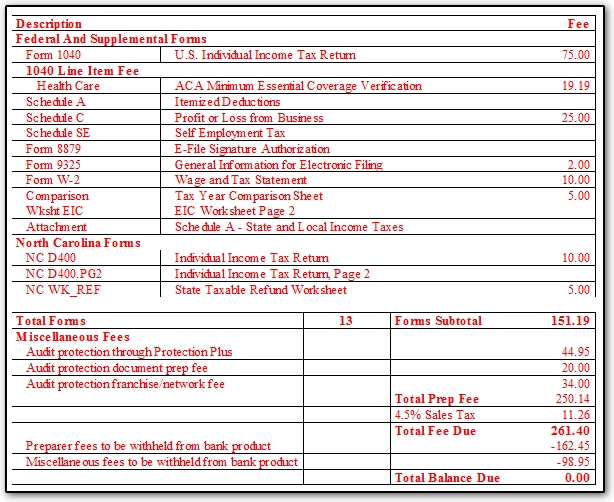

The example below is a return with a bank product and audit protection fees. The enhanced bill is displayed.

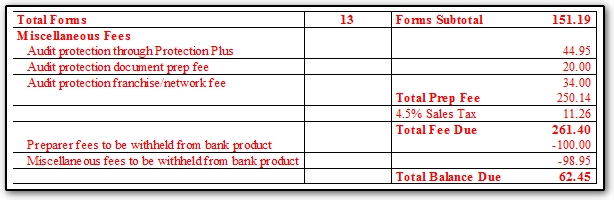

Here, there is no screen 1 fee override. The Forms Subtotal is withheld from the bank product as "Preparer fees..." and the audit protection fees are withheld as "Miscellaneous fees...":

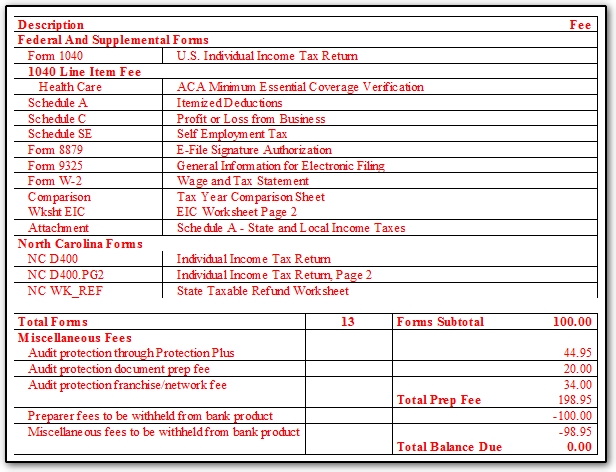

With a $100 Fee Override entered on Screen 1, the Forms Subtotal becomes $100 and the fees for individual items are removed:

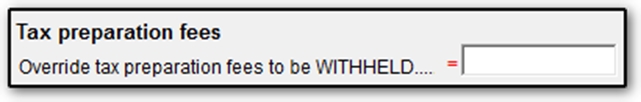

Bank Screen Fee Override

A Tax Preparation Fees bank product withholding override is available on bank screens (if partnered with a bank). This override affects the amount withheld from a bank product, but does not affect the amount billed:

The example below from the same return, with a $100 Tax Preparation Fee override on the bank screen but no fee override on screen 1, results in a balance due, because the amount withheld from the bank product does not cover the Forms Subtotal. Audit protection fees are not affected by the bank screen Tax Preparation Fee override.

If the override exceeds Forms Subtotal and Miscellaneous fees, there is no balance due on the bill, but the override amount is withheld and shown in bank documents.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!