How do I set up a third party designee on a return?

You can set up a global third party designee, or you can enter a designee on a return-by-return basis. If you set up a global designee, you can still override the global selection inside a specific return.

Starting in tax year 2020, the third party designee section is located on Form 1040, page 2.

In tax year 2019, the third party designee indicator appears in one of two locations on Form 1040, page 2, depending on who is the designee.

- The Third Party Designee section is only completed (and the Yes box marked) if the designee is someone other than the paid preparer.

- If the paid preparer is also the 3rd party designee, there is a checkbox 3rd Party Designee in the Paid Preparer Use Only section of Form 1040 that will be marked. In this circumstance, nothing will appear in the Third Party Designee section.

In tax year 2018, third party designee information for someone other than the return preparer flows to Schedule 6. See Related Links for details.

For all years, if there is no third party designee on the return, only the No checkbox is marked in the Third Party Designee section. This occurs if NONE is selected globally or if the PREP screen override is used. See below for more information on these options.

Global Setup

- On the Setup > Options > Optional Items on Return tab, select an option from the drop list Third party designee. Your choices are:

- None -This option does not generate a third party designee. You can still indicate a 3rd party designee on a selective basis (see below).

- Preparer 1 through 9 - You can select any one of the first nine preparers that you have set up at Setup > Preparer(s).

- Return Preparer. This option uses the current preparer for each return.

- ERO. This option uses the preparer indicated in the Default ERO drop down menu on the Setup > Options > EF tab.

- For the selected designee under any of these choices, you must

- enter a 5-digit PIN at Setup > Preparer(s),

- enter a telephone number under Setup > Firms.

- If you have selected ERO, the preparer shown on the Setup > Options > EF tab, as Default ERO, must have a PIN.

- If you have selected Return Preparer, the return preparer for each return must have a PIN. If there is no PIN entered under Setup > Preparers, that preparer will not appear as the third party designee, even if selected globally.

- To override the third party designee from within a return, use the PREP screen information described below.

Individual Setup

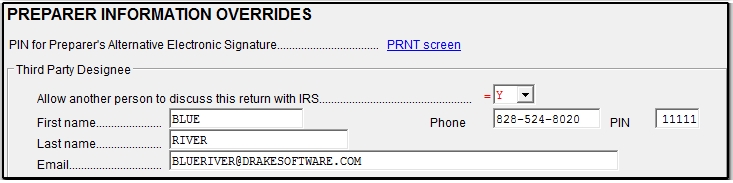

To indicate a third party designee,

- In the return, open the PREP screen.

- Select Y from the drop list Allow another person to discuss this return with IRS,

- Enter the third party designee information, including:

- First Name - If not entered, EF Message 0767 generates.

- Last Name - If not entered, EF Message 0767 generates.

- Phone - If not entered, EF Messages 0767 and 5933 generate.

- PIN - If not entered, EF Messages 0767 and 5933 generate.

- Email - optional.

To indicate NO third party designee on a single return,

- In the return, open the PREP screen.

- Select N from the drop list Allow another person to discuss this return with IRS.

Important: if you select Y and do not complete the rest of the block, no third party information will be shown but there will be EF messages preventing e-filing. Y overrides any global third party designee information with what is entered on the PREP screen.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!