Where do I enter a 1098-T?

Enter information from Form 1098-T - Tuition Statement, on screen 8863 for the taxpayer, spouse or dependent. Enter details for the school (EIN, Name, address, etc.) on the 8863 screen > Form 8863 tab. Be sure to answer all questions and indicate which education benefit is being claimed for the student (if applicable). This completes line 22 (and the related information) in Part III of Form 8863 in View mode.

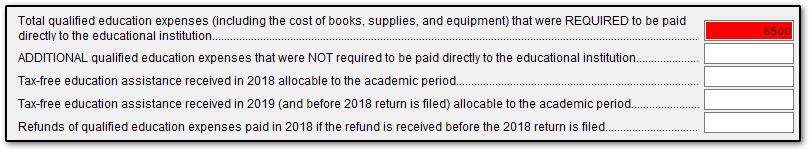

If there are multiple schools attended by the same student, use the Educational Institutions tab on the 8863 screen to enter information for up to five additional institutions. If needed, you can enter a detail worksheet (CTRL + W) to report the amounts from multiple 1098-T Forms received on the line(s):

For help determining which lines and amounts from 1098-T should be entered on Form 8863, see the Instructions for Form 8863.

EF Messages 4913, 5969, or 5970 may generate if you do not answer all required questions on the 8863 or 8867 screens.

Resources:

See Related Links below for more details on the 8863 data entry screen and education credits.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!