Is Form 1040-SS or 1040-PR available in Drake Tax?

Form 1040-SS can be generated and e-filed using Drake Tax.

Note: The software does not support the filing of a Form 1040 and Form 1040-SS/1040-PR in the same return. Currently, Drake Tax only supports the filing of a Form 1040 or a Form 1040-SS/PR. See below for details on generating Form 1040-SS/1040-PR instead of Form 1040.

Puerto Rico Form 482 is not supported in Drake Tax.

Form 1040-PR is only available for creation and e-filing through Drake22. Form 1040-PR is no longer available after Drake22.

Drake23

- On Open/Create select or create the return.

- If creating a new return, choose Return Type Individual - 1040.

- Complete the basic demographic information using the relevant screens (i.e. Name and Address, Dependents, etc.).

- Note: Do not enter Form W-2PR for Puerto Rican wages on the W2 screen; screen W2PR is available on the Miscellaneous tab instead.

- If the W2 is from another U.S. Territory (American Samoa, Commonwealth of the Northern Mariana Islands, Guam, U.S. Virgin Islands), the W2 screen should be used, but you will need to check the applicable box at the bottom of the Additional Entries tab (W-2AS, W-2CM, W-2GU, or W-2VI). EF Message 3705 generates until data entry is corrected.

- On the Miscellaneous tab, open the SS screen.

- Check the box Taxpayer is not required to file Form 1040 and is filing Form 1040-SS instead.

- Select which country the Taxpayer is a bona fide resident of.

- If you select Puerto Rico, you must also enter the Modified AGI under Part II (see the F1 field help for details).

- In view mode, you will see Form 1040-SS generated instead of Form 1040.

- To produce Form 1040-SS in Spanish, go to the PRNT screen and check the box Produce federal forms in Spanish (if available).

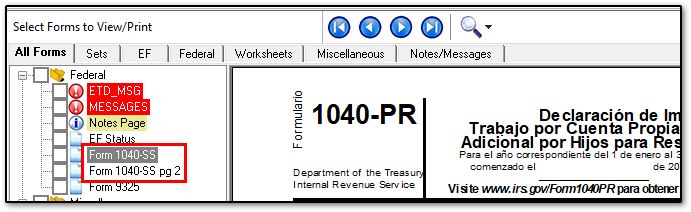

- You may need to re-order your federal forms if you do not see Form 1040-SS available in the Federal section. See Related Links below for details.

Drake22

- On Open/Create select or create the return.

- If creating a new return, choose Return Type Individual - 1040.

- Complete the basic demographic information using the relevant screens (i.e. Name and Address, Dependents, etc.).

- Note: Do not enter Form W-2PR for Puerto Rican wages on the W2 screen. A new screen W2PR is available on the Miscellaneous tab instead.

- If the W2 is from another U.S. Territory (American Samoa, Commonwealth of the Northern Mariana Islands, Guam, U.S. Virgin Islands), the W2 screen should be used, but you will need to check the applicable box at the bottom of the Additional Entries tab (W-2AS, W-2CM, W-2GU, or W-2VI). EF Message 3705 generates until data entry is corrected.

- On the Miscellaneous tab, open the SSPR screen.

- Check the box Taxpayer is not required to file Form 1040 and is filing Form 1040-SS or 1040-PR instead.

- Select which country the Taxpayer is a bona fide resident of.

- If you select Puerto Rico, you must also enter the Modified AGI under Part II (see the F1 field help for details).

- In view mode, you will see Form 1040-SS generated instead of Form 1040.

- If you want to produce Form 1040-PR instead, go to the PRNT screen and check the box Produce federal forms in Spanish (if available). The form will still be called Form 1040-SS in the tree, but the form will print in Spanish as Form 1040-PR. Form 1040-PR can only be produced if the taxpayer is a bona fide resident of Puerto Rico.

- You may need to re-order your federal forms if you do not see Form 1040-SS available in the Federal section. See Related Links below for details.

In Drake21 and prior, Forms 1040-SS and 1040-PR are not available in the software.

- The fillable form (in Spanish) is available on the IRS website: 1040-PR.

- Instructions for the 1040-PR are also available: 1040-PR Instructions.

The IRS provides forms in English as well:

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!