Is an EIN (Employer Identification Number) required on the ERO or firm setup screen?

It may be possible to e-file without an EIN, since a preparer PTIN is now required for e-filing and will appear in the transmission file. You should enter an EIN on the ERO and Firm(s) screens. Some states may still require it.

To apply for an EIN, go to How to Apply for an EIN. Applications can be submitted to the IRS online or by phone, fax or mail.

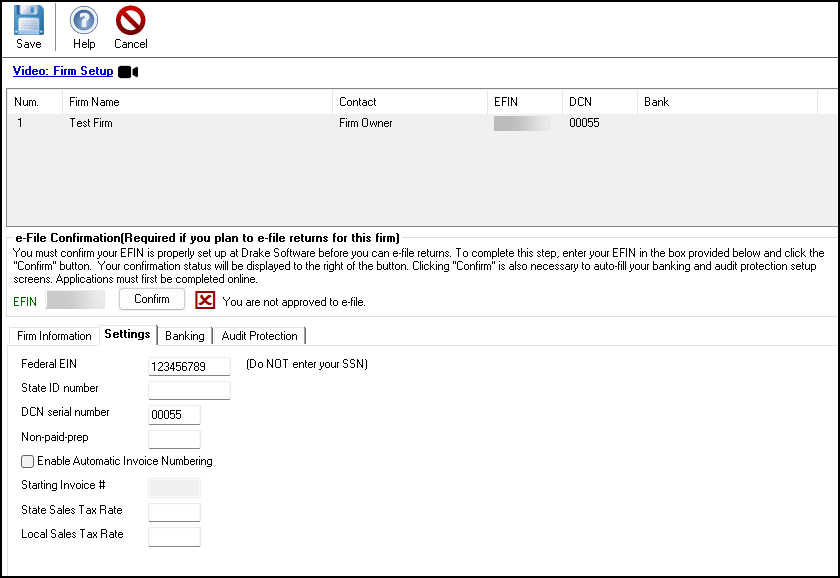

To enter the EIN in the software, go to Setup>Firm(s)>Settings tab and enter the firms Federal Employer Identification Number (EIN) in the field Federal EIN.

The software will allow you to key only numbers for a Federal EIN entry. A PTIN cannot be entered in the EIN field. Do not key an SSN in the EIN field. If a firm does not have an EIN, this field should be left blank.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!