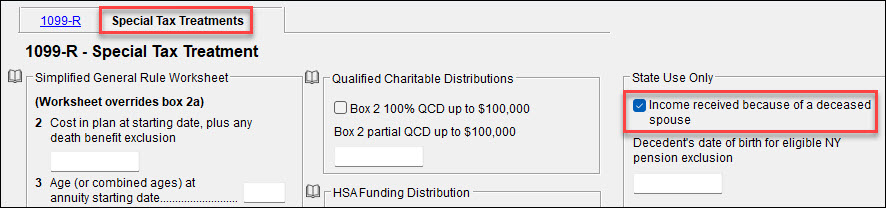

Where do I mark the 1099-R as income received because of a deceased spouse?

Open the 1099-R data entry screen for that income and select the Special Tax Treatments link at the top of the screen. At the right, under the For state use only section, select Income received because of a deceased spouse. This check box is for state use only and does not affect the federal return.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!