How do I enter depreciation or depletion on Schedule E in a fiduciary return?

Depreciation

In Drake Tax, you can enter depreciation on screen 4562 and point it (using the For box) to Schedule E (using the Multi-form code to identify the instance of Schedule E if there is more than one E screen). The software calculates AMT.

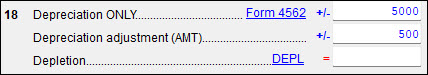

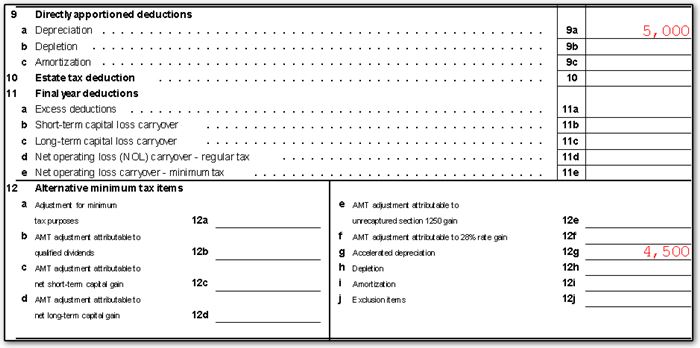

There are also 3 separate line 18 entries for Depreciation ONLY, Depreciation adjustment (AMT), and Depletion on screen E, Expenses tab under Expenses attributable to rental unit. For an entry on the Depreciation ONLY line, an entry must also be made on the Depreciation adjustment (AMT) line (even if 0 adjustment is needed).

The software treats a direct entry in these fields as depreciation and makes an AMT adjustment for the full amount entered in the AMT field, which is displayed on Wks Sch K-1.

By default, Drake will carry the depreciation to the beneficiary's Form K-1. If the depreciation should instead be flowing to the Schedule C, E, or F, see "1041 - Carrying Depreciation to Schedule C, E, or F" in Related Links below.

Depletion

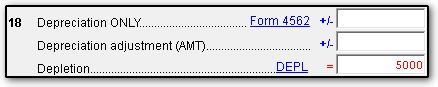

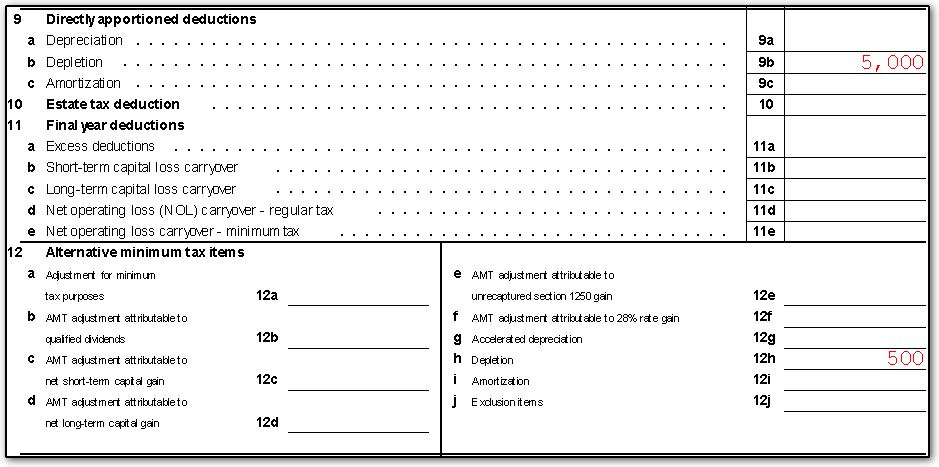

For depletion, use screen E, Expenses tab, line 18 field for depletion to make your entry.

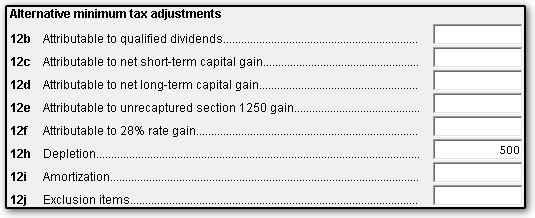

If an AMT adjustment for depletion is needed, this entry can be made on the WKK1 screen line 12h.

The software treats a direct entry in these fields as depletion and makes an AMT entry for the full amount entered in the AMT field of the WKK1 screen, which is displayed on Wks Sch K-1.

Note: In Drake15 and prior, there is a single, combined line 18 Depreciation/depletion field on screen E for entry of Direct Expenses. For an entry here, you may also have to make an AMT adjustment on screen E. The AMT entry can be made in the bottom corner of screen E.

For depletion, use screen WKK1 (line 9b) to recategorize part of all of a combined line 18 Depreciation/depletion field entry as depletion. Recategorizing depreciation as depletion does not adjust the AMT (shown as accelerated depreciation on worksheet WK_K1.)

You must determine what AMT adjustments are needed as a result of the re-categorization. Adjust AMT for changed depreciation on screen E.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!