In a fiduciary return, how do I choose to distribute all income, or just capital gains?

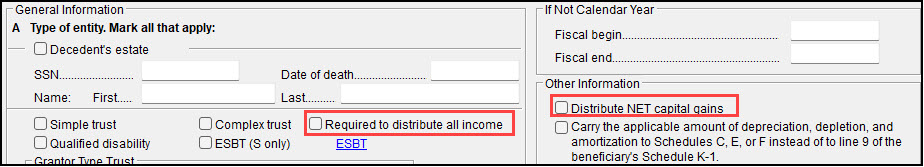

On Federal screen 1, choose Required to distribute all income and/or Distribute NET capital gains.

The Required to distribute all income check box

indicates that all amounts, except capital gains, must be distributed

to the beneficiaries, even if it distributes amounts other than income during the year. This includes interest, dividends, and other

income amounts. Simple trusts do not need to mark this box since a simple trust has to distribute all income to be qualified as such.

The Distribute NET capital gains check

box indicates that the net amount of capital gains should be

distributed to the beneficiaries. Note that net capital gains are

distributed by default in the final year of the estate or trust.

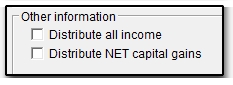

In Drake22 and prior, choose Distribute all income and/or Distribute NET capital gains from the Other Information section of screen 1:

The Distribute all income check box indicates that all amounts, except capital gains, should be distributed to the beneficiaries. This includes interest, dividends, and other income amounts.

The Distribute NET capital gains check box indicates that the net amount of capital gains should be distributed to the beneficiaries. Note that net capital gains are distributed by default in the final year of the estate or trust.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!