How do I clear New York EF Message 0199?

NY EF Message 0199 states:

NY - Locality withholding tax reported on a 1099-G

NY does not allow the e-file of returns reporting locality withholding tax on a 1099-G

NYS GUIDANCE:

(1) Do not report local withholding on a NYS issued 1099-G;

(2) Include the local withholding in the state withholding amount;

(3) and Read the NYS DTF information below

INFORMATION RECEIVED FROM NY DTF:

The Dept. of Labor only allows for the election to withhold Federal and State withholding tax on NYS Unemployment. The 1099-G that is issued by them would never include local withholding tax, nor does the taxpayer have the ability to request that the Dept. of Labor withhold local withholding tax.

Guidance received from New York specifically addresses how to record local withholding that is reported on Form 1099-G (Other Government Payments). The state of New York requires any local withholding reported on a Form 1099-G to be combined with the state withholding and then reported as a combined total in the State withholding field on the federal 99G screen.

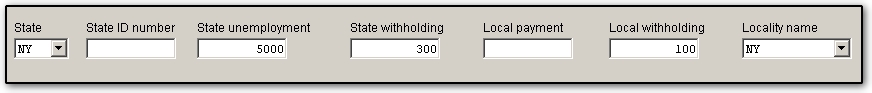

Below is an example of a scenario that will prompt EF Message 0199:

To correct EF Message 0199:

- locate the 99G containing the entry for New York Local Withholding.

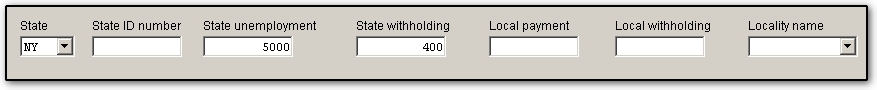

- Take note of the amount reported in the Local withholding field and remove it.

- Increase the amount in the State withholding field by the amount removed from Local Withholding.

Below is the corrected scenario information:

NY EF Message 0199 disallows e-filing of the state return because the State of New York rejects returns submitted with amounts entered in the Local withholding field using rejection codes R-0130 and R-0132.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!