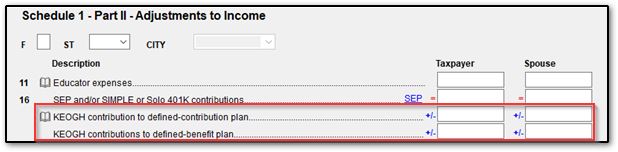

Where can I enter a Keogh contribution to a defined contribution or defined benefit plan?

Keogh contributions may be entered on screen 4 Adjustments, line 16 (line 28 in Drake18 and prior), in an individual return. Amounts entered here adjust any amounts coming from the SEHI screen and carry to Schedule 1, line 16 (Schedule 1, line 28 in Drake18).

For more information, see Retirement Plans for Self-Employed People and Publication 560.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!