Can I have more than one return type for the same SSN/EIN inside Drake Tax?

It is possible to have multiple returns for the same SSN or EIN in Drake Tax as long as they have different return types. Detailed steps are included below.

Note: Backup the client file(s) before proceeding with the steps outlined in this article. For instructions on backing up a client file to a USB drive, CD or other external location, see Related Links below. For a demonstration, watch the video Backup & Restore.

Creating a file with multiple return types:

After successfully backing up the client file, proceed with the following steps:

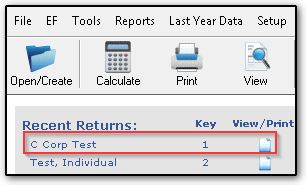

- Open the client return of which you will be changing the return type.

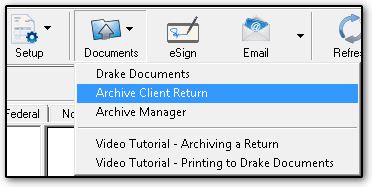

- Go to the View mode of the tax return.

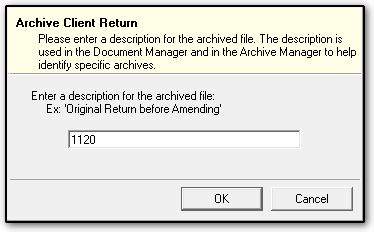

- From the top menu bar, select the Documents button (Archive button in prior years) and select Archive Client Return. Enter the current return type (i.e. 1120-S, 1065). For a demonstration, watch the video Archiving a Return.

- Once the archive is successfully created, Exit the tax return going back to the main page of the software.

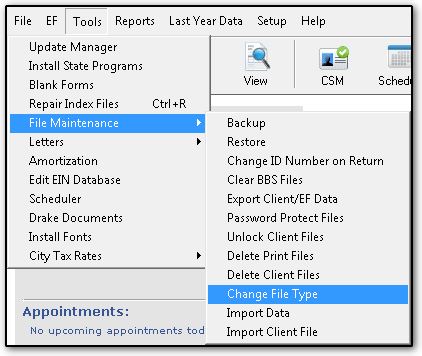

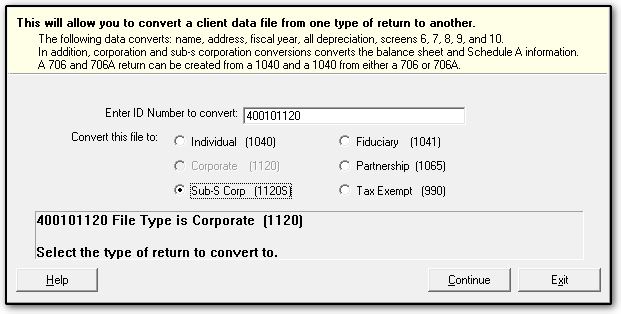

- Go to Tools > File Maintenance > Change File Type. For a demonstration, watch the video Changing File Type.

- Enter the client SSN/EIN and select the return type to which you would like to convert. Continue and confirm.

- Re-enter the tax return (now the changed return type) and go to the View mode of the tax return.

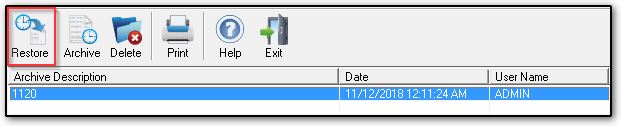

- Select the Documents button (Archive button in prior years) from the top menu and go to Archive Manager.

- Highlight the original return type shown in the lower portion of this screen and select Restore from the top menu.

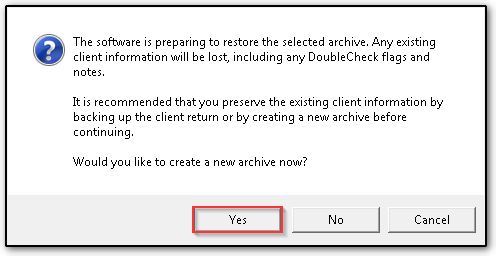

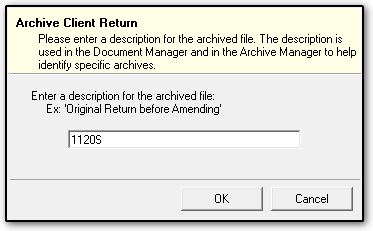

- You will be prompted to create a second archive, select Yes and enter the current return type (i.e. 1120-S, 1065).

- You will receive a pop-up that says 'Archive Saved Successfully' followed by, 'Archive Restored Successfully'.

-

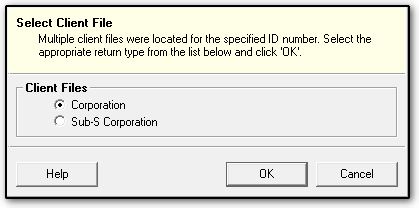

Exit the return and then reopen the selected client. You will receive a 'Select Client File' window. Select the return type you would like to currently view.

Note: To switch between the return types, Exit the return and reopen it from the main page of Drake. It will prompt you to choose which return type you would like each time you enter the client file.

Deleting files with multiple return types:

If you need to delete either of the return types created (or both) you can do so with the following steps:

Caution: This permanently removes the file from your software database. It cannot be restored unless you made a backup copy before deleting the file.

- From the main page of Drake, go to Tools > File Maintenance > Delete Client Files.

- Enter the SSN/EIN of the return you would like to delete. Continue.

- Select the return type you would like to delete. Continue.

- Confirm that the correct client file is being deleted.

- Repeat steps 2-4 if you would like to delete additional return types for the SSN/EIN.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!