If I am receiving EF Message 0012 on a 1065 return, how would I clear this message?

You are referring to this message:

INFORMATION REQUIRED FOR SCHEDULE B-1 - Schedule B-1 must be completed on partners owning 50% or more of the Partnership at the end of the tax year. Go to screen B-1 and complete data for lines 2a or 2b as required.

This message is produced when any of the partners on the return own an interest of 50% or more in the partnership.

To clear this message, in data entry, go to the B1 Schedule B-1 Ownership Information screen and complete either line 2a or 2b, as required, depending on the type of partner that holds the interests of 50% or more in the partnership.

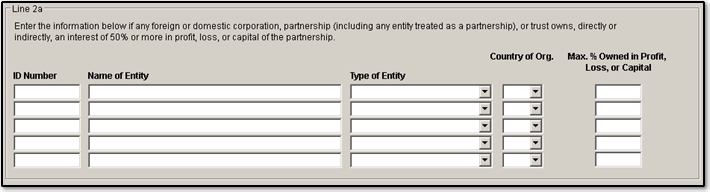

Line 2a (Line 3a in 2017 and prior) would be completed if a foreign or domestic corporation, partnership (including any entity treated as a partnership), or trust owns, directly or indirectly, an interest of 50% or more in profit, loss, or capital of the partnership.

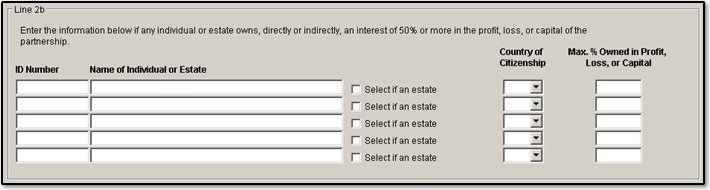

Line 2b (Line 3b in 2017 and prior) would be completed if an individual or estate owns, directly or indirectly, an interest of 50% or more in the profit, loss or capital of the partnership.

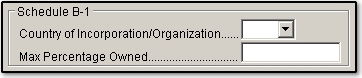

Beginning in Drake18, this information can also be entered at the top of the partner's K1 screen, in the Schedule B-1 section.

For additional guidance, see the 1065 instructions.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!