Where can I enter taxes for line 3, Taxes on or Measured by Income or Fees or Payments in Lieu of Income Taxes, for the Kansas corporate return?

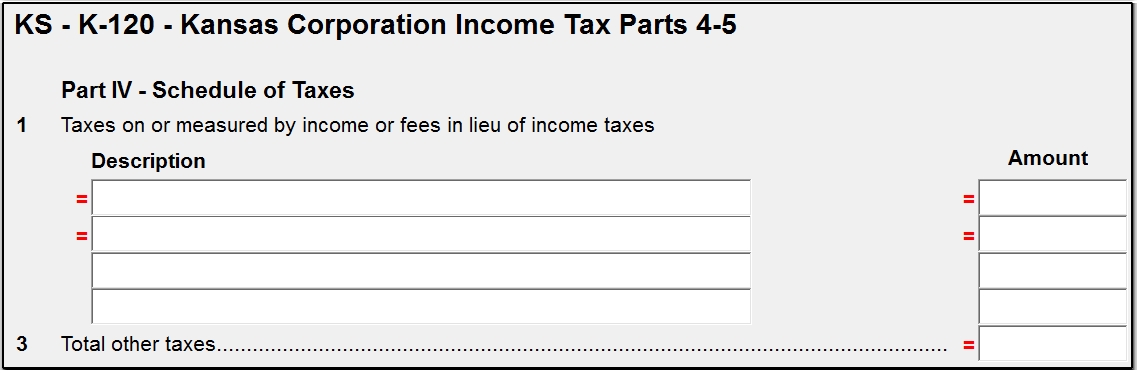

The instructions indicate that the taxes on or measured by income or fees or payments in lieu of income taxes should flow from Part IV, line 2. This data entry is located on KS > Screen 5 (K-120 Page 4 Schedules).

Descriptions and Amounts entered here will flow first to the KS120.PG4. Then the total will carry to the KS120, page 1, line 3.

According to the KS Department of Revenue, the taxes paid in lieu of income tax are:

- franchise tax based on income

- windfall profit tax

- the federal environmental tax.

Franchise Estimated Payments will flow from the federal ES screen. All other taxes that apply will have to be entered directly in this field.

See the KS Corporate Income Tax Instructions and Statute 79-32,177 for more information about taxes on or measured by income or fees or payments in lieu of income taxes.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!