GA Low Emissions Vehicle Credit

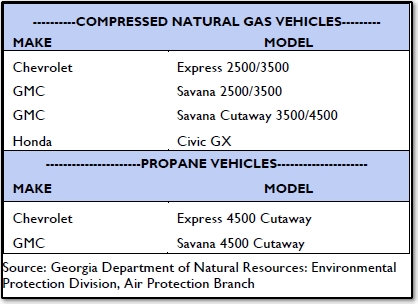

The GA Low Emissions Vehicle Credit (LEV) is a credit for the purchase or lease of a vehicle powered solely by an alternative fuel that was purchased on or before June 30, 2015. Hybrid electric, flex fuel, and bi-fuel vehicles do not qualify for this credit. Georgia’s Department of Natural Resources recognizes only six vehicles as eligible for this credit:

The GA LEV credit is equal to 10% of the vehicle cost, or $2500, whichever is less. The credit can be claimed up to five years from the lease or purchase date. The amount taken cannot exceed the tax liability for any tax year, but any amount that is not used can be carried forward for up to five years from the close of the tax year in which the vehicle was leased or purchased.

The credit can be entered in Drake by going to States > GA > Credits > CR3 – Non INDCR Credits screen. Select code 116, and complete all other applicable data entry fields.

The credit will carry to GA 500PG.8 in view to calculate the amount of the credit used, and any applicable carryover. If paper filing, the taxpayer will also need to attach the original approved Certification Form(s), obtained from the vehicle dealer or the GA Environmental Protection Division, to their GA Form 500 Individual Income Tax Return. The certificate is not required to be attached to electronically filed returns.

See the GA IT-511 Instructions and Georgia Clean Vehicle Tax Credits for further information.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!