How can I clear Maryland EF Message 0008, regarding the state pickup contributions.

MD EF Message 0008 states:

An entry has been made for subtraction "R" on the MD 502 screen; however, the 1099-R does not reflect a taxable amount. Per the MD Department of Revenue, the subtraction "R" is limited to the amount of pickup contribution stated on the 1099-R or the taxable pension, whichever is less. Either take out the subtraction "R" or fill in boxes 14, 15, and 16 on all 99R screens.

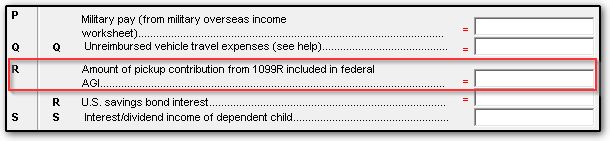

EF Message 0008 will produce when the amount of state pickup contributions on the MD SUB (Subtractions) screen, line R exceeds the amount that has been reported on the federal 1099 - 1099-R Retirement Income screen. This subtraction is limited to the amount of pickup contribution stated on the 1099-R or the taxable pension, whichever is less. Excess contribution may be carried forward to the next year.

If no entry is made in this override field, the value will flow from the local distributions on any federal 1099-R screens where STPICKUP is entered in one of the locality fields (see Related Links below for more information).

To clear this EF message, in data entry, do one of the following:

- Go to the States tab> MD (Maryland) > SUB (Subtractions) screen and remove any amount in line R that exceeds the amount reported for pickup contributions, or

- Return to the federal 1099 - 1099-R Retirement Income screen and fill in boxes 14, 15, and 16 for each instance of this screen.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!