I am receiving a Kansas EF Message 0127 about the KS-40 Credit for Taxes Paid to Other States. How can I clear this message?

EF Message 0127 states:

KS K-40 Credit for taxes paid to other states. You have entered schedule C, E, or F income from a state other than KS. KS does not include schedule C, E, or F income in KS AGI. The override for other state's AGI will need to be entered on the CR screen without the schedule C, E, or F income included.

Kansas no longer includes the Schedule C, E or F income in the AGI calculation. Since KS does not include these amounts, it is necessary to make an adjustment on the Kansas OSC screen if there are Schedule C, E or F amounts present for other states for which you are claiming this credit.

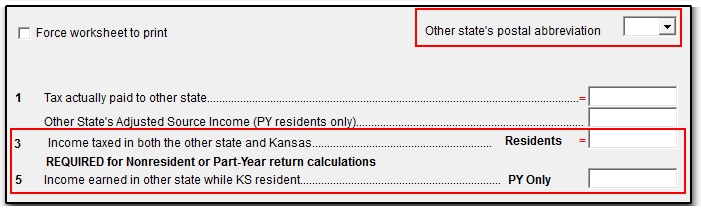

To clear this EF Message, return to data entry > States tab > KS Kansas > Credits tab > OSC (Other State Tax Credit) screen. On this screen it is necessary to enter the other states postal abbreviation and enter the other states AGI without including the Schedule C, E or F income. This would be done on line 3 for KS residents or line 5 if the taxpayer is a Part-Year or Nonresident of Kansas. Once these entries have been made, the error should clear.

For more information about the Kansas subtraction changes or KS Credit for Taxes paid to Other States, see Related Links below.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!