Does Drake Tax track the basis for an inherited IRA?

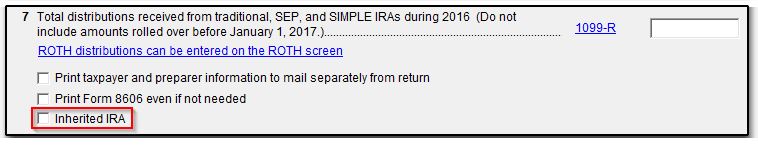

If the taxpayer had an inherited IRA, mark the Inherited IRA check box on screen 8606.

When the above box is marked, Drake Tax will track the basis of this IRA separately from any other IRAs the taxpayer has, and will also produce a separate Form 8606 in view mode for the inherited IRA.

See Publication 590-B for more information on inherited IRAs.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!