I am getting a Return Note 303 about a split return charge on this client's bill. I did not split this client's return.

If at any point the Split button (or Ctrl + S) has been selected from data entry, but the split return was not saved, a Return Note 303 will generate within the View/Print mode of the return. If the charge should remain, disregard the note, as it will not stop the e-filing of the return. If the return should have been split, see, "Creating, Saving and Deleting Split Returns" in the Related Links below.

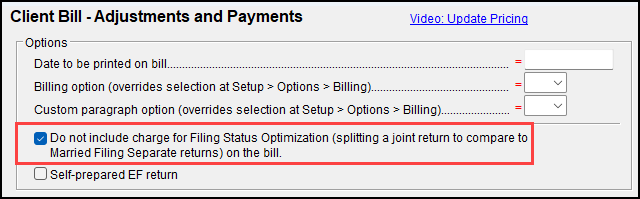

If the return should not have been split, and the charge removed, return to the Miscellaneous tab within data entry, and on the Bill - Client Adjustments screen, check the ''Do not include charge for Filing Status Optimization'' box. This will remove the line item charge from the bill, but will not clear the note. The note will continue to exist in the View mode, but will not stop the return from being e-filed.

Return Note 303 reads:

SPLIT RETURN CHARGE ON BILL. This return was previously split, but the

individual returns were not saved. Because of this, there is no

MFS_COMP worksheet present but there may be a charge for it on the

bill. This charge can be removed by marking the "Do not include..."

option on the BILL screen.

For more information on Split returns, see Related Links below or the Drake Software User's Manual.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!