How do I clear EF Message 5292?

See the Form 8615 Instructions and Related Links below for the filing requirements.

The parent may be able to elect to report the child's interest, ordinary dividends, and capital gain distributions on the parent's return. If the parent makes this election, the child will not have to file a return or Form 8615. However, the federal income tax on the child's income, including qualified dividends and capital gain distributions, may be higher if this election is made. For more details, see Form 8814, Parents' Election To Report Child's Interest and Dividends.

If the filing requirements are met on a return, but screen 8615 has not been completed, EF Message 5292 generates. To resolve, follow the applicable instructions:

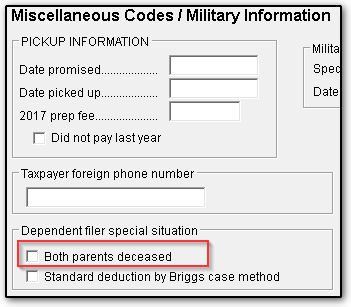

- If both parents are deceased, Form 8615 is not required. To clear EF Message 5292, go to the MISC screen, located on the Miscellaneous tab of data entry and check the box Both parents deceased under Dependent filer special situation in the lower-left corner of the screen.

If one or more parent is living, complete screen 8615 for each living parent. Press Page Down to enter a second parent's name, SSN, and income information. For more information on this form, see Related Links below.

*Per the 8615 Instructions:

- "Unearned income includes taxable interest, ordinary dividends, capital gains (including capital gain distributions), rents, royalties, etc. It also includes taxable social security benefits, pension and annuity income, taxable scholarship and fellowship grants not reported on Form W-2, unemployment compensation, alimony, and income (other than earned income) received as the beneficiary of a trust."

- "Earned income includes wages, tips, and other

payments received for personal services performed."

- "Your support includes all amounts spent to provide the

child with food, lodging, clothing, education, medical and dental

care, recreation, transportation, and similar necessities. To figure

your child’s support, count support provided by you, your child, and

others. However, a scholarship received by your child isn’t

considered support if your child is a full-time student."

If a Wks 8615 is generating erroneously on a return, ensure that the date of birth for the taxpayer on federal screen 1 is entered and accurate.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!