Setup

To prepare employee payroll with overtime, you must have set up the basic employee information.

Note: Overtime is not available for salaried employees.

For overtime setup, review these options:

Employees > Options > Payroll Options tab: Consider the option Store all overtime pay separate from regular pay.

- The option is unselected by default, which results in a separate display of Overtime Premium for overtime hours (the difference between the regular and the overtime pay rate).

- Selecting the option results in a separate display of total Overtime Pay for overtime hours.

Take as an example, 40 hours at their regular pay rate ($8.00/hr) with 15 hours of overtime (paid at time and ½):

If the box is unchecked, the amounts are displayed as:

$8.00 X 40 = $320.00

$8.00 X 15 = $120.00 (added to the regular pay 320.00 + 120.00 = 440.00)

$4.00 X 15 = $60.00 (Overtime rate at ½ of regular pay)

Gross Earnings = $500.00

With the box checked, the amounts are displayed as:

$8.00 X 40 = $320.00

$12.00 X 15 = $180.00

Gross Earnings = $500.00

Employee > Employee Setup > Payroll Wages/Rates tab: Click to select an employee. These options must be set individually for each employee.

Pay Class – select Hourly for an hourly employee

Pay Frequency – select the option appropriate for the employee

Overtime Factor – the software defaults to an Overtime Factor of 1.5. You can enter a different factor if necessary.

- The factor applies only to the selected employee.

Rates – enter the appropriate pay rate and description (if applicable). This rate will be used to calculate regular and overtime pay.

- Multiple rates can be set up for each employee.

- You must enter hours worked for each pay rate when you prepare payroll, discussed below.

Click Save to save changes for an employee and then proceed to the next employee.

Preparation of overtime payroll

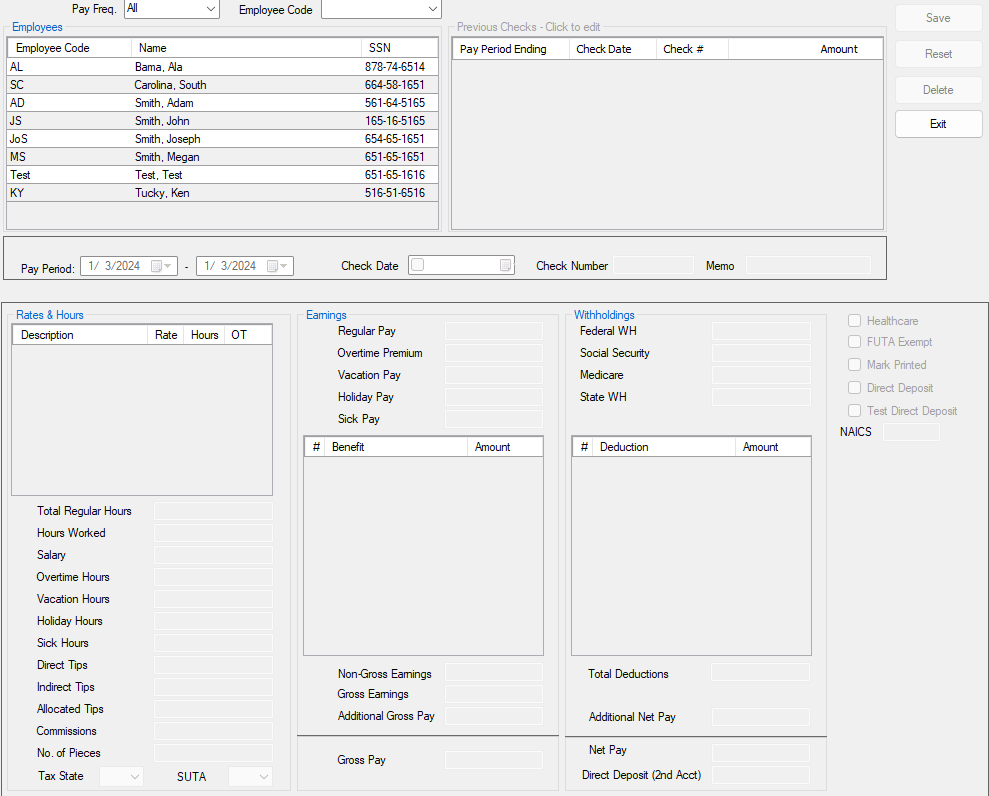

Go to Employees > Payroll > Live or ATF.

Employee with a single pay rate only

The Rates & Hours section displays the rate that you previously set up for the employee. The rate:

- can be edited as an override

- is used as the basis for current payroll for the employee,

- is applied to the Total Regular Hours field

Employee with additional pay rates

The Rates & Hours section displays all the pay rates that have been entered for the employee. The Hours field for each pay rate is initially displayed as the Default Hours Per Pay Period indicated under Employee Setup > Payroll Wages/Rates. All fields are editable as overrides. When multiple pay rates have been set up for the employee

- Hours must be entered for each pay rate. Do not include overtime hours.

- Results in the Earnings Grid are based on the Rates and Hours section.

Overtime - all employees

Enter overtime hours in the OT field towards the left of the screen (do not include overtime hours in the regular Hours field).

- The required overtime amount is calculated and displayed in the Earnings Grid. The overtime rate and the pay rate to which it applies are what you previously set up for the employee.

- Overtime hours and pay will be displayed in the Hours Report (Employees > Reports > Hours Report).

3.jpg)

If you directly edit overtime in the Earnings grid, overtime hours and pay are not displayed on the Hours Report. To maintain report integrity, enter overtime hours as directed above.