Why are the royalty expenses being reported on page 2 of the Pennsylvania Schedule M (PA SCH M PG2)?

Beginning in 2017, royalty income reporting on the PA20S65 is reported slightly differently. Now, only the royalty revenue (income) amount will be reported on the Pennsylvania Schedule M, page 1. Royalty expenses will be separately reported on the Pennsylvania Schedule M, page 2. Prior to tax year 2017, the net royalty income (revenues minus expenses) was reported as one lump sum on the PA Schedule M, page 1. While the appearance and location has changed, the net taxable value reported for royalty income remains the same.

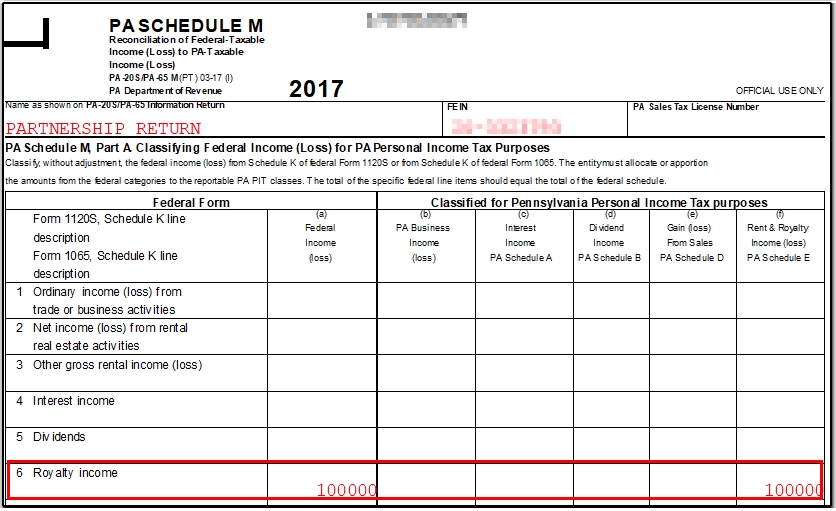

For example, a client reports royalty receipts of $100,000 and $50,000 of expenses on the federal 8825 screen. The total receipt amount of $100,000 is reported on line 6 of the PA Schedule M, page 1:

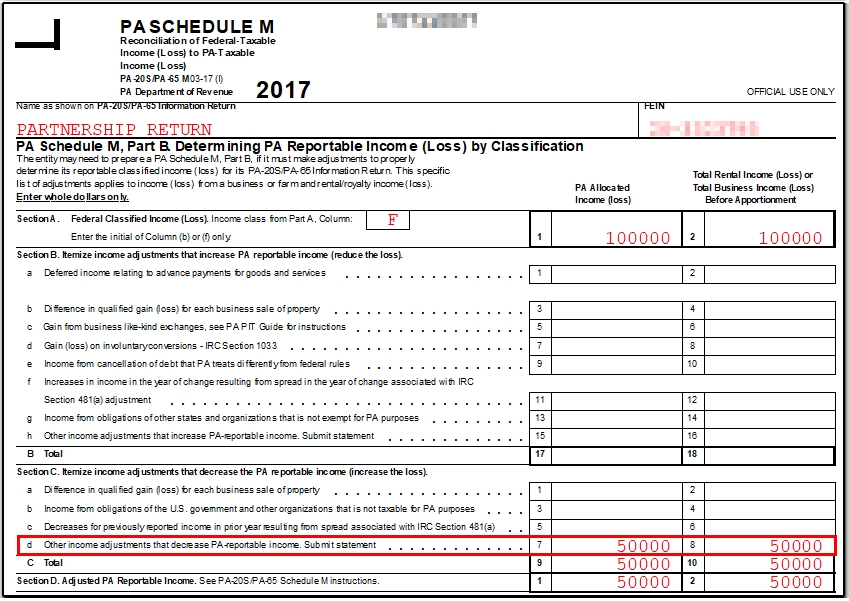

The expenses of $50,000 are reported on line 7 or line 8 (if the Royalties did not originate from PA sources) of the PA Schedule M, page 2:

The expenses are also shown on the PAM2CDAT attachment in view mode.

In 2016 and prior, the net $50,000 amount would have been reported on the PA Schedule M, page 1, column F without detailing the expenses on page 2.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!