Why am I getting red message 0214 on this Massachusetts return?

Massachusetts now requires that the amounts on MA NR/PY, page 2, line 8 match the total of MA Schedule C income, line 31 and MA Schedule F income. If the federal Schedule C or Schedule F income needs to be allocated between MA and another state, you can no longer use the MA NR screen, line 13 to apportion business/professional or farm income/loss (Income type being apportioned code 8). Starting in 2017, this causes EF message 0214 on a non-resident return and prevents e-file:

The Business/Profession or Farm income/loss amount does not agree with the Schedule C and/or the Schedule F.

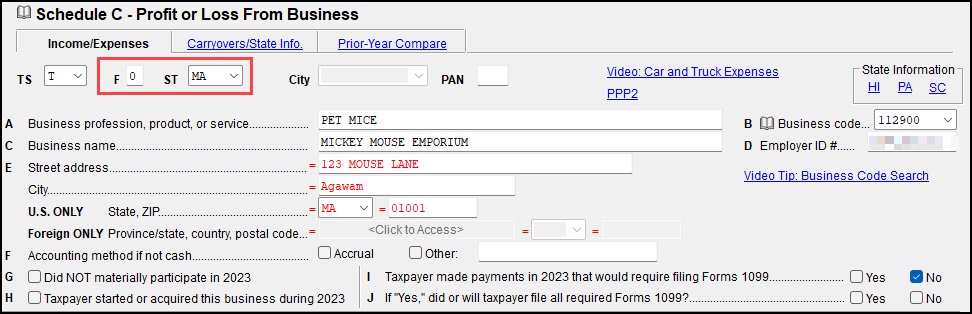

The MA Schedule C and F income and expenses are carried from the federal data entry screen(s) where MA is listed as the state in the ST drop down box. If the federal income and expense amounts are not the amounts that should be reported on the MA non-resident return, a second schedule C and/or F screen must be created to record only the MA amounts. To avoid duplicating amounts on the federal return, be sure to enter a 0 (zero) in the F box to suppress that entry screen from the federal return.

This will allow only those MA amounts to be carried to the MA NR return.

Note: If the taxpayer had multiple businesses/farms in multiple states, it may not be necessary to suppress subsequent screens from the federal return. The above scenario applies to a business/farm for the taxpayer who had activity in MA and another state that was previously reported on a single federal schedule C or F screen. This process will allow you to allocate income as needed to MA without duplicating federal income/expenses.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!