Drake Accounting®: What do I need to e-file 1099 Forms?

This article discusses the process of applying for approval to e-file Forms 1099. For information on creating and e-filing live Forms 1099, see Related Links below.

In order to e-file using the Combined Federal/State Program:

- You must have a Transmitter Control Code (TCC). (If you don’t have one, see Related Links.)

- You must have a FIRE account. To set up a FIRE account, go to https://fire.irs.gov and click Create New Account

- You must have specific IRS e-file

approval to file Combined Program 1099 information. An overview of the process is provided by IRS

- Note: Combined Program approval requires test e-filing.

- Combined Program approval authorizes you to e-file both

- Federal only, and

- Combined Federal and state 1099 information.

- The state to which you are filing must be a participant in the Combined Program (see Publication 1220 for details and a list of states).

Test e-File

You must have a valid 1099 already

created in DAS, which serves as the test file. Note that Forms 1099 cannot be

processed or e-filed in current year DAS software until later in the year when updates are issued to enable these end-of-year functions.

- Create the test file

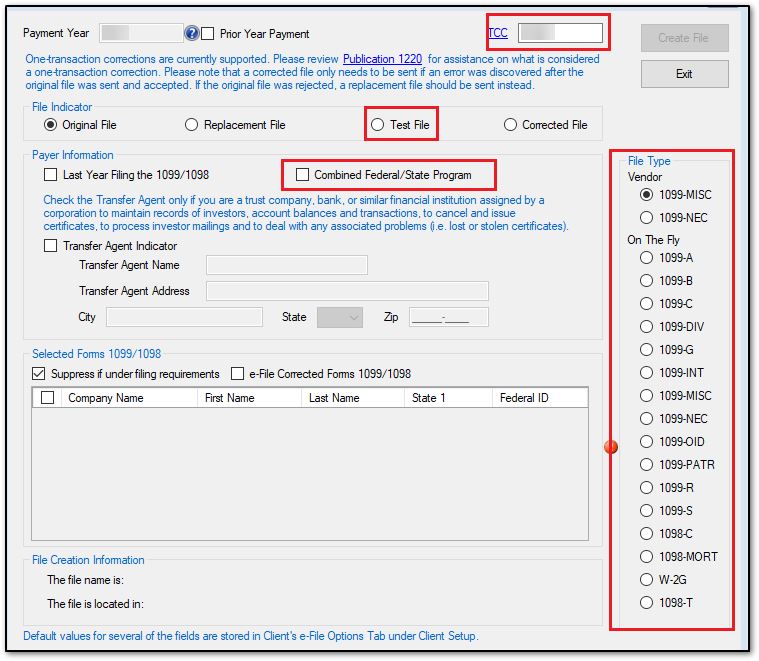

- At e-Filings > 1099/1098 > Create File

- Make sure your TCC (Transmitter Control Code) is entered.

- Select Test File.

- Select Combined Federal/State Program.

- Select the appropriate 1099 type that you have already created from Vendor or On The Fly.

- Click the Create File button that was just enabled to create the test file.

- At the bottom of the screen, you will find the file name and location.

- Transmit the test file.

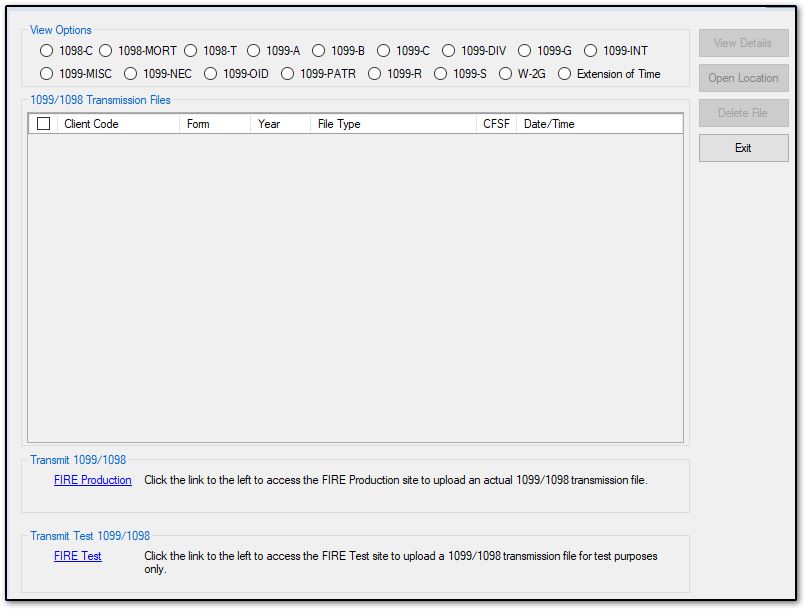

- e-Filings > 1099/1098 > Transmit File.

- Click FIRE Test and follow instructions and prompts on the FIRE site to transmit the test return.

- The IRS receives and

reviews the test file. They will then e-mail you an acceptance letter, if it is approved. Per Publication 1220, "A test file is only required for the first year a filer participates in the program; however, it is highly recommended that a test

file be submitted every year. Records in the test and actual file must conform to current procedures.... Some participating states require separate notification that the payer is filing in this manner. The IRS acts as a forwarding agent only. It is the payer’s responsibility to contact the appropriate state(s) for further information."

*If using Hosting on Right Networks, files are saved by default to the I:\ drive. See Related Links below for further information on how to locate e-file forms from within the Hosting on Right Networks Desktop.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!