Drake Accounting®: How can I get a copy of Form 8879-EMP for my records?

If you e-file a Form 94x as an ERO, you are required to prepare and keep Form 8879-EMP for four years. Form 8879-EMP is produced when you print the Form 94x. (If you e-file as a reporting agent, Form 8879-EMP is not required or produced.)

You are e-filing as an ERO if Transmit as ERO is selected on the e-File Options tab within the Client > Edit or Add window.

To comply with IRS instructions, Form 8879-EMP must be completed and signed before the electronic return is transmitted (or released for transmission).

Prepare Form 8879-EMP.

Follow these steps. Form 941 is used below as an example.

- Prepare the 941 and click Save on the data entry screen.

- Print the document. The last two pages of the PDF displayed on your screen are Form 8879-EMP and the form instructions.

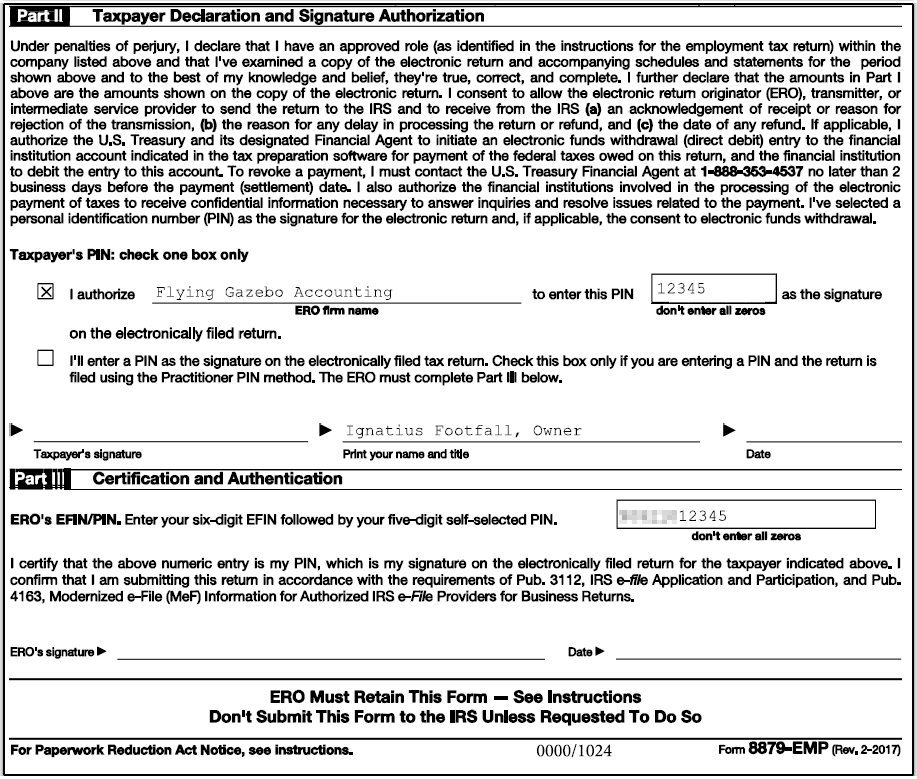

- In Parts II and III of the printed Form 8879-EMP (shown below)

- The taxpayer should:

- Check the appropriate box in Part II.

- Sign on the Taxpayer's signature line. The printed name, title, and date have been completed by the software.

If requested, photocopy the completed form for the taxpayer’s records. Follow the Form 8879-EMP Instructions regarding retention:

"Don't send Form 8879-EMP to the IRS unless requested to do so. Retain the completed Form 8879-EMP for 4 years from the return due date or IRS received date, whichever is later."

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!