Why is my depreciation on this vehicle less than what I expect?

In Drake Tax, assets that have a selection in the Listed Property Type drop list are subject to additional rules and limitations depending on the year of the software as well as the year placed in service.

Listed Property is defined as any of the following:

- Passenger automobiles,

- Any other property used for transportation, unless it is an excepted vehicle (See Publication 946 for excepted vehicle explanations),

- Property generally used for entertainment, recreation, or amusement (including photographic, phonographic, communication, and video-recording equipment).

Deductions for listed property (other than certain leased property) are subject to special rules and limits.

- Deduction for employees. If your use of the property is not for your employer's convenience or is not required as a condition of your employment, you cannot deduct depreciation or rent expenses for your use of the property as an employee.

- Business-use requirement. If the property is not used predominantly (more than 50%) for qualified business use, you cannot claim the section 179 deduction or a special depreciation allowance. In addition, you must figure any depreciation deduction under the Modified Accelerated Cost Recovery System (MACRS) using the straight line method over the ADS recovery period. You may also have to recapture (include in income) any excess depreciation claimed in previous years. A similar inclusion amount applies to certain leased property.

- Passenger automobile limits and rules. Annual limits apply to depreciation deductions (including section 179 deductions and any special depreciation allowance) for certain passenger automobiles. You can continue to deduct depreciation for the unrecovered basis resulting from these limits after the end of the recovery period.

In Drake Tax, there are 6 options for Listed Property Type. Limits are applied based on the date placed in service and the selection made.

- V - Vehicle, cars under 6,000 lbs. (limits apply)

- E - Electric vehicle (limits apply)

- T - Trucks and vans (limits apply)

- H - Vehicles in the 6,000-to-14,000-pound range

- used for heavy sport utility vehicles (SUV) and certain other vehicles placed in service during the tax year. You cannot elect to expense more than $27,000 (for 2022) of the cost when this code is selected, however, regular depreciation after the year placed in service is not limited.

- N - Non-Limited Vehicle (Vehicle to which limits do not apply)

- used to mark a vehicle as a listed property that is not subject to any of the rules or limits of other vehicle types.

- X - Listed property other than vehicle

- used for listed property other than vehicles such as computer and related peripheral equipment. Important: The Tax Cuts and Jobs Act removed computers and peripheral equipment from the definition of listed property. This change applies to property placed in service after December 31, 2017. Refer to FS-2018-9 for more information.

Note: If the business use percentage of the asset is less than 100%, you must reduce the maximum deduction amount by multiplying the maximum amount by the percentage of business use determined on an annual basis during the tax year.

For additional depreciation rules on earlier years, refer to Publication 946 Chapter V and the Form 4562 Instructions.

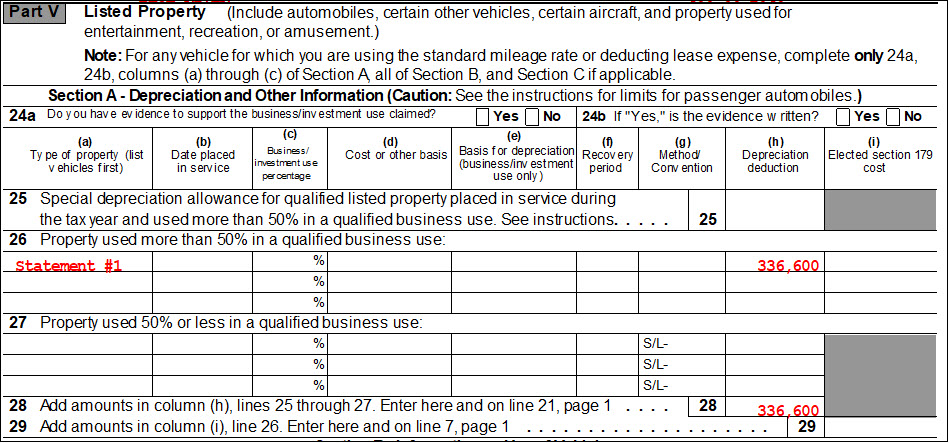

A selection of any of the above codes in the listed property drop list will carry the asset to Form 4562, Part V with the applicable limitations applied.

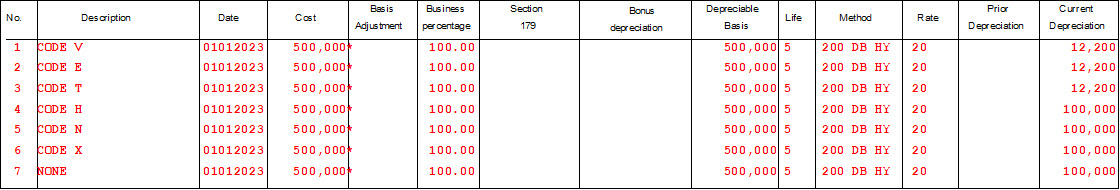

For example, these assets were all placed into service on the same date, have the same cost, and depreciation method chosen, however, the depreciation amount allowed is different due to the Listed Property Type chosen (shown as the description in this example of the Federal Depreciation Schedule):

Section 179 and Listed Properties

For assets designated as a listed property type, the EXP method of depreciation should not be selected. In the 1040 package, EF messages 5515 and 5623 generate (similar messages will appear in other return types) which detail that another depreciation method must be selected. See Publication 946 for details.

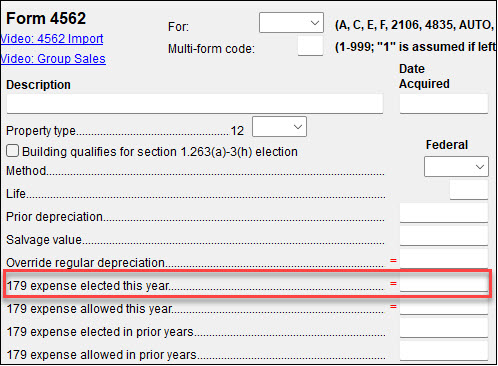

In order to reflect Section 179 expense on a listed property asset, the amount of elected 179 will need to be manually entered on the 4562 depreciation detail screen, on the 179 expense elected this year line.

If the elected amount entered is greater than the allowable limit for the asset, the software will automatically adjust the Section 179 expense allowed for the asset.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!