Drake Accounting®: How do I file an extension for a W-2, W-2G, 1098, 1099 or other information return?

To request an extension, complete and file Form 8809, Application for Extension of Time To File Information Returns. Form 8809 is available under Tools > Print Blank Forms > Federal > Miscellaneous > 8809 or under On The Fly> Federal Forms > Miscellaneous > 8809.

Note: Extension requests for Forms 1099-NEC, 1099-QA, 5498-QA, and W-2 must be submitted on paper

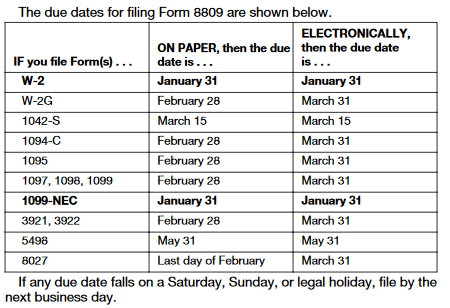

The due dates for non-extended informational returns are:

Extensions on Form 8809 may be requested:

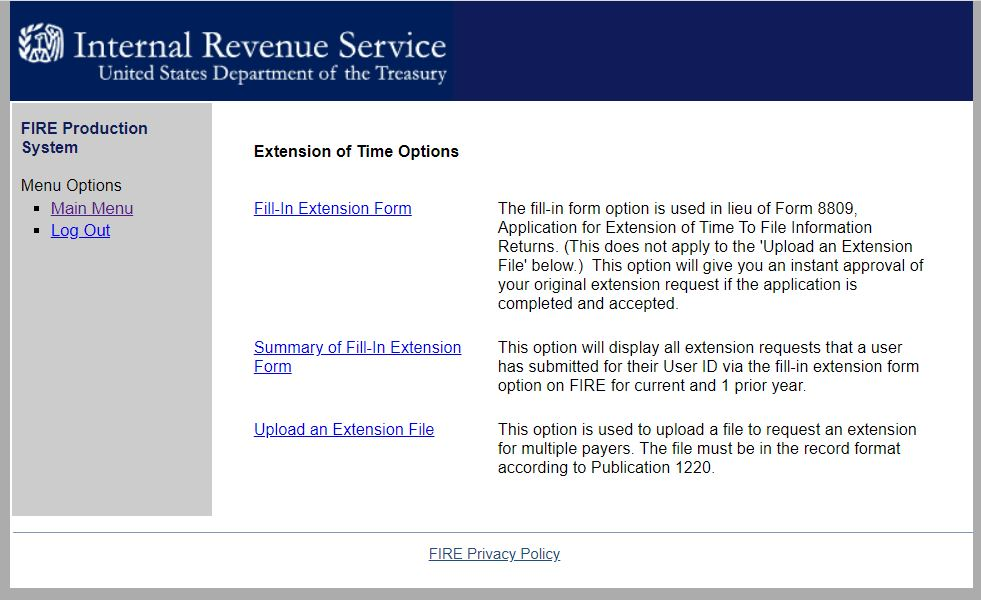

- Online (preferred):

- Complete the fill-in Form 8809 through the IRS FIRE system.

- After logging in, select “Extension of Time Request” from the Main Menu Options.

- Acknowledgements are automatically displayed online if the request is made by the due date of the return.

- On paper - Form 8809:

See the Form 8809 Instructions for more information, other filing options, or to access a fillable PDF of the form.

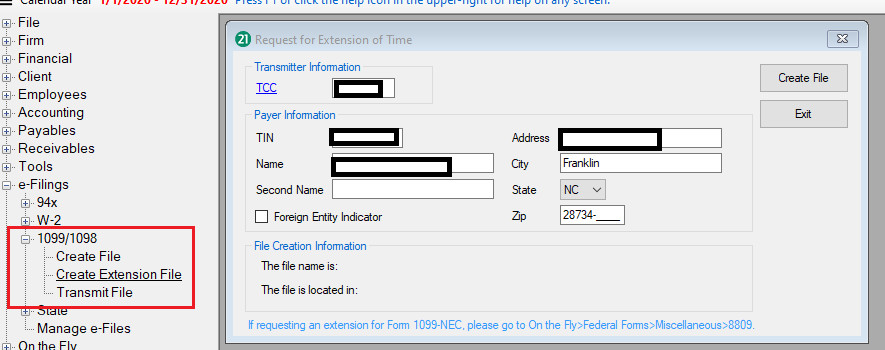

Alternatively, for a 1099 series return extension only, complete the following steps:

-

Go to e-Filings > 1099/1098 > Create Extension File.

- Enter the TCC.

Note: A Transmitter Control Code must be obtained to e-file 1099/1098 information. This is a five-character alphanumeric code assigned by the IRS/ECC-MTB.

- Complete the Payer Information section:

- TIN — Enter the nine-digit Taxpayer Identification Number assigned to the taxpayer. A number that is all zeros, ones, twos, etc., results in an invalid TIN.

- Name — Enter the name of the payer whose TIN has been entered. If additional room is needed for the name, use the Second Name field.

- Foreign Entity Indicator — Select this box if the payer is a foreign entity.

- Address — Enter the address of the payer. The street address should include number, street, apartment or suite number, or PO Box if mail is not delivered to a street address.

- City — Enter the city, town, or post office of the payer.

- State — Enter the two-character state code.

- Zip — Enter the nine-digit ZIP code assigned by the U.S. Postal Service. If only the first five digits are known, then use the five-digit ZIP code.

- Click Create File.

To transmit Forms 1099 and 1099 extension requests:

- Go to e-Filings > 1099/1098 > Transmit File.

- Click the FIRE Production Link to access the IRS FIRE website and upload Forms 1099 and 1099 extension requests.

- Click the FIRE Test Link to access the IRS FIRE test website. Use this to send a test file for a state that you have not previously uploaded to the IRS.

- Once connected to the FIRE website, click Log On.

- Enter your TCC, EIN, Company Name, User ID and Password (the password is case sensitive) and click Login.

- Click Continue.

- Click Send Information Returns.

- Click Submit.

- Click Accept.

- Click either Original File or Replacement File (if the original return had a BAD status).

- Enter your 10-digit PIN and click Submit.

- Click Browse to locate the file and open it.

- Click Upload.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!