Which Ohio Generic City returns can be e-filed?

In Drake20, the following localities currently support e-file:

- ALLIANCE

- BOTKINS

- BROOKVILLE

- CINCINNATI

- COVINGTON

- CRIDERSVILLE

- DAYTON

- DELAWARE

- DUBLIN

- FORT LORAMIE

- GRANVILLE

- GREEN CITY

- LAKEVIEW

- MARYSVILLE

- MASON

- MIDDLETOWN

- MINSTER

- NEW BREMEN

- NEW KNOXVILLE

- NEW PHILADELPHIA

- NORTH STAR VILLAGE

- OSGOOD VILLAGE

- RUSSIA

- SAINT MARYS

- STRASBURG

- TIPP

- VANDALIA

- WAUSEON

- WESTERVILLE

- WHITEHALL

To generate the Ohio Generic Municipality Form, go to the Ohio > Generic Cities tab > GEN screen. Select the generic city name in the City of drop list at the top of the screen, otherwise this form will not print automatically.

Use the TSJ box to designate for whom the form is being filed. This will determine the name and income information that prints on the form. The generic return will default to Joint on MFJ returns.

Once you select the city and TSJ code for the return, all entries made on the other tabs will automatically be attributed to that city. The label at the top of the screen will indicate the city as well as whether the screen is for Taxpayer or Spouse. There is no need to select the city on the other tabs.

Pressing Page Down on any tab will move to a new General Information screen and allow you to create another generic return.

Residency will be determined by the "Resident City" field on federal screen 1 of the tax return. If the city on the Generic return does not match the resident city then the form will be calculated as a nonresident. Resident returns will automatically pick up most taxable income types (see below). Nonresident returns will pick up income only if the income is designated for that city. Residency may be overridden on the General Information screen.

The following income will flow to the Generic form: W-2, 1099-R, Schedule C, Schedule F, Schedule E, 4835, and K1P.

- Schedule C, F, E, 4835, and K-1 income will automatically be included on any generic return calculated as a resident.

- K-1 (partnership) income will include ordinary income, rental real estate, other rental income, and guaranteed payments.

- Income from these forms may be excluded from the resident generic city return by entering a zero in the "City" drop down field at the top of the federal screen. If there are multiple screens entered for a particular form, you must enter a zero in each screen to be excluded.

- 1099-R income will only be included if a local distribution amount is keyed on the 1099 screen.

- W-2 income will only be included if OH is in box 15 and the Locality name is keyed on the line along with the local wage and withholding (see below). A resident return will include all city income and withholding shown on the W-2. Wages WILL NOT flow from box 18 of the W-2. They must be entered in the locality section and the appropriate city selected for the wage.

- If the city is marked as not a resident, in order for the income to flow to the generic return, the state selected on the federal screen must be OH and the city name must be entered in the City or Locality field.

Losses on lines 2, 3 and 4 will offset income on lines 2, 3, and 4 and will be reduced by any prior year loss on line 5 by default. These four lines will total on line 6. Line 6 will then combine with the net wages to determine taxable income. An overall loss on line 6 will not reduce wages by default. If the city allows this you must either check the box at the bottom of the Income screen to indicate so or you may override the taxable income on line 8. A global option is also available under Setup > Options > States > OH to offset wages with losses if the city you primarily prepare allows this. Note that if you set this, it will apply to all generic cities prepared, so use caution.

Canton: If the return is for Canton, Schedule E losses on line 3 will not be allowed to offset any income. Canton does not allow passive losses to offset non-passive income and those losses must be carried forward.

2021 estimated tax will automatically be calculated on each generic return. It will be based on the information calculated on the current return. Those amounts may be adjusted as needed on the estimated tax screen. The calculation may be suppressed by the check box in the estimate section.

Electronic filing of the generic return is available for select cities. If there are no city messages printing, then the city return will be eligible and will show as eligible on the EFSTATUS page printing with the return. It may also be selected on the EF Options Override screen in the state-only section by selecting OHGEN.

Note: To prevent the Federal and State returns from being transmitted while transmitting the city return(s), go to the EF Selections screen, mark the box "Do NOT send Federal," in the Federal e-file override section, and use the first State e-file override drop down to select OHGEN.

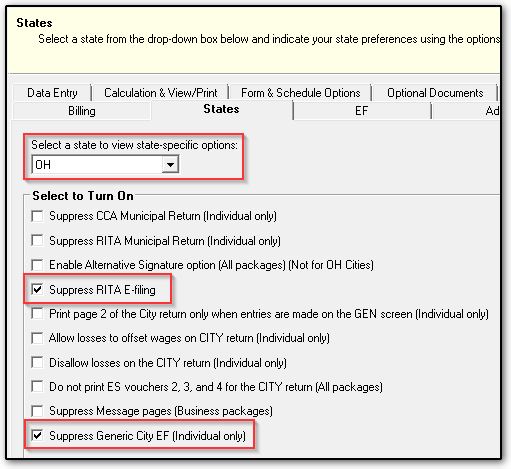

To suppress E-Filing of the Ohio Generic City returns on a global basis, from the main screen of Drake Tax select Setup > Options > States tab > Select OH from the drop list. Check the box Suppress Generic City EF (Individual Only). Click OK at the bottom of the screen to save your changes.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!