How can I clear California EF Messages related to CA3514 and Business Demographic Information?

There are several EF messages that can generate regarding this form and Business information.

CA EF Message 0075 / 0076 states:

CA3514 Missing Business Demographic Information

This return has business income on CA3514 line 18 but is missing the business name/address.

Drake Tip:

If this has a Schedule F or K1P then the overrides for business information on CA Screen EIC must be used.

CA EF Message 0078 / 0079 / 0080 states:

CA3514 Missing Business Demographic Information

This return has business income on CA3514 line 18 but is missing the business city/state/zip code in the address.

Drake Tip:

If this has a Schedule F or K1P then the overrides for business information on CA Screen EIC must be used.

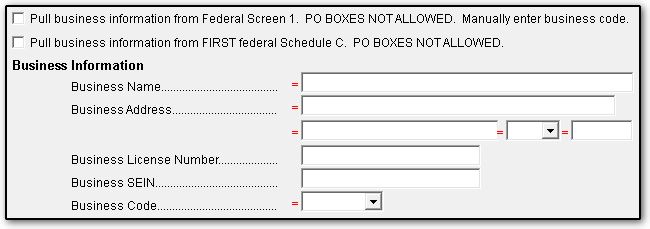

To clear these messages, if there are multiple Schedule Cs on the return, go to the States tab > CA > EIC screen and do one of the following:

- Mark the box to Pull business info from Federal screen 1,

- Mark the box to Pull business info from the FIRST Schedule C, or

- Fill out the Business Information section (overrides).

If the business income is coming from a federal Schedule F or K1P, the Business Information overrides must be used.

Note:

- If option 1 above is used, the business code must be entered in the Business Information section.

- Click in the Business Code box and press Ctrl+Shift+S to open a search box to easily find codes.

- P.O. boxes are not valid entries for the Business address on this form.

- If the only source of business income on a return is a single Schedule C, the software will automatically pull the business information to the form.

Note: If you are receiving any of these red messages, but do not have CA business income, review federal screens C, F, and K1P to make sure CA is not selected in the ST drop list.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!